What Is Umbrella Insurance & Why High Income Families Need It in 2026

What Is Umbrella Insurance & Why High Income Families Need It in 2026

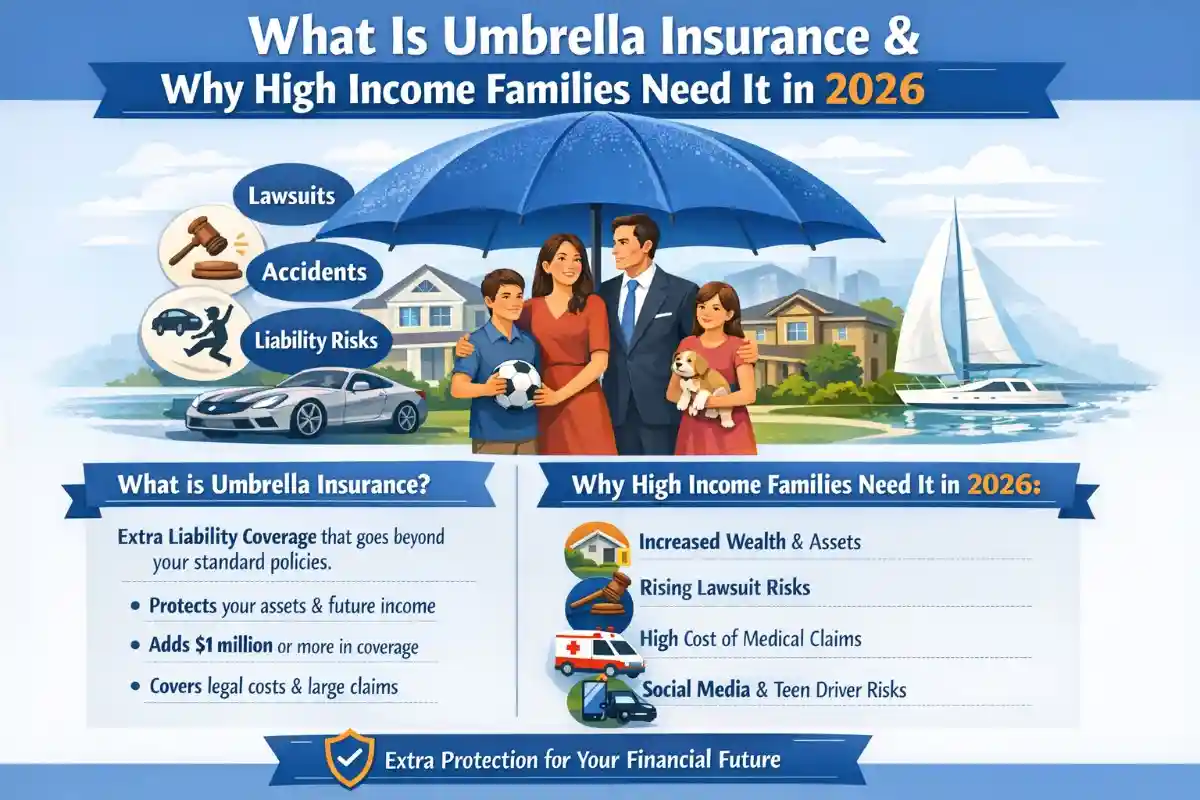

In 2026, high income families face more liability exposure than ever before. With rising lawsuit settlements, social media defamation risks, increased auto accident litigation, and expanding personal asset portfolios, standard home and auto insurance policies are often no longer sufficient.

This is where umbrella insurance — also known as excess liability insurance — becomes a critical component of a comprehensive wealth protection strategy.

If your household earns six or seven figures annually, owns real estate investments, has teenage drivers, travels internationally, or maintains significant liquid assets, a personal umbrella policy can protect your wealth from catastrophic legal claims.

This in-depth 2026 guide explains what umbrella insurance is, how it works, coverage limits, costs, who needs it most, and how high-net-worth families can use it to protect their financial future.

What Is Umbrella Insurance?

Umbrella insurance is a personal liability policy that provides additional coverage beyond the limits of your homeowners, auto, or watercraft insurance policies. It activates when underlying policy limits are exhausted.

For example:

- Your auto policy covers $300,000 in bodily injury liability.

- You cause a major accident with $1.2 million in damages.

- Your umbrella policy covers the remaining $900,000.

Without umbrella insurance, your personal savings, brokerage accounts, investment properties, and even future wages could be at risk.

Why High Income Families Face Greater Liability Risk in 2026

Affluent households are statistically more likely to be targeted in lawsuits because they have recoverable assets. In Tier 1 countries like the United States, Canada, the UK, and Australia, legal judgments frequently exceed $1 million.

Key risk factors include:

- Teen drivers in the household

- Luxury vehicles

- Swimming pools or trampolines

- Rental properties

- Domestic staff

- Public online presence

- Board memberships

What Does Umbrella Insurance Cover?

- Bodily injury liability

- Property damage liability

- Libel and slander

- False arrest or imprisonment

- Legal defense costs

- International liability coverage (varies by policy)

Some policies also include coverage for landlord liability and uninsured motorist protection extensions.

Coverage Limits Available in 2026

| Coverage Limit | Ideal For | Estimated Annual Cost |

|---|---|---|

| $1 Million | Upper middle-income families | $150–$300 |

| $2 Million | High earners with teen drivers | $300–$500 |

| $5 Million | High net worth households | $500–$900 |

| $10 Million+ | Ultra high net worth families | $1,000+ |

Premiums vary based on risk factors, property ownership, driving records, and state regulations.

Top Umbrella Insurance Providers in 2026

- Chubb Personal Risk Services

- AIG Private Client Group

- PURE Insurance

- State Farm

- Allstate

- Nationwide

High-net-worth families often choose specialty carriers like Chubb or AIG due to higher coverage limits and global liability protection.

How Much Umbrella Insurance Do You Really Need?

A common rule of thumb is:

Total Net Worth = Minimum Umbrella Coverage

Example:

- $3M net worth → $3M umbrella coverage minimum

However, income potential should also be considered, especially for physicians, executives, attorneys, and business owners.

Umbrella Insurance vs Asset Protection Trusts

Umbrella insurance provides first-line financial protection. Asset protection trusts provide legal shielding. High-income families often use both strategies for layered protection.

Real-Life Claim Scenarios

Scenario 1: Teen Driver Accident

A 17-year-old causes a multi-vehicle accident resulting in $2.4M in damages. Standard auto policy covers $500,000. Umbrella policy covers the remaining $1.9M.

Scenario 2: Social Media Defamation Lawsuit

A viral post leads to a $750,000 defamation settlement. Umbrella policy covers legal defense and settlement costs.

Scenario 3: Rental Property Injury

A tenant injury results in a $1.5M judgment exceeding landlord policy limits.

What Umbrella Insurance Does NOT Cover

- Intentional criminal acts

- Business liability (requires commercial umbrella)

- Professional malpractice

- Contract disputes

Umbrella Insurance for Business Owners

If you own an LLC or corporation, you may require a separate commercial umbrella policy. Personal umbrella coverage does not extend to business liability exposures.

Tax Considerations

Personal umbrella insurance premiums are generally not tax-deductible. However, landlord-related umbrella coverage may have partial deductibility depending on jurisdiction.

Pros & Cons of Umbrella Insurance

Pros

- Affordable high-limit coverage

- Protects assets & future earnings

- Covers legal defense costs

- Peace of mind for affluent households

Cons

- Requires underlying coverage minimums

- Does not cover business/professional liability

- May exclude certain high-risk exposures

How to Get the Best Umbrella Insurance Quote in 2026

- Increase underlying auto/home liability limits first.

- Bundle policies with same carrier.

- Maintain clean driving record.

- Review net worth annually.

- Consult an independent insurance broker.

Final Thoughts: Is Umbrella Insurance Worth It?

For most high-income families, umbrella insurance is one of the most cost-effective risk management tools available in 2026. For a few hundred dollars per year, you can protect millions in personal assets.

In an increasingly litigious society, failing to carry sufficient liability coverage can jeopardize decades of wealth accumulation. When combined with strategic estate planning and asset protection strategies, umbrella insurance forms a critical pillar of financial security.

Frequently Asked Questions

Is umbrella insurance necessary if I already have high auto limits?

Yes. Major lawsuits frequently exceed $1M, especially in severe injury cases.

Does umbrella insurance cover lawsuits abroad?

Some high-end policies provide worldwide coverage — confirm with your insurer.

Can I buy umbrella insurance without home insurance?

Most insurers require underlying home or renters insurance coverage.

Disclaimer: This article is for informational purposes only and does not constitute legal or insurance advice. Coverage terms vary by provider and jurisdiction. Consult a licensed insurance professional for personalized guidance.