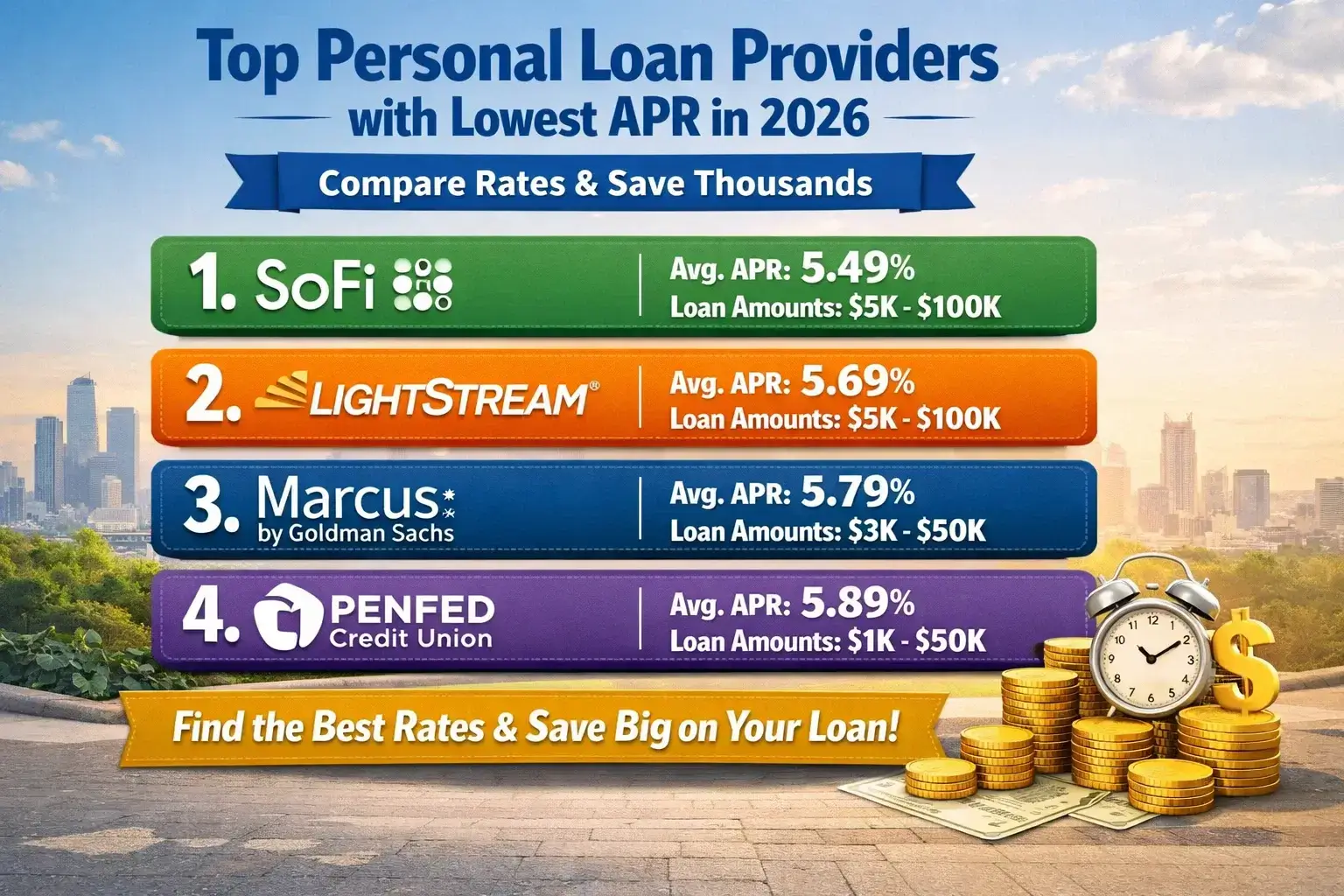

Top Personal Loan Providers with Lowest APR in 2026 – Compare Rates & Save Thousands

Personal loans remain one of the most competitive and high-value financial products in Tier 1 countries including the United States, United Kingdom, Canada, and Australia. In 2026, lenders are aggressively offering low APR unsecured personal loans, flexible repayment terms, instant online approval systems, and high borrowing limits to attract prime and near-prime borrowers.

If structured correctly, a low interest personal loan can save you thousands of dollars in interest — especially when used for debt consolidation, credit card refinancing, home improvement, medical expenses, or business expansion. This in-depth guide covers everything you need to know about finding the lowest APR personal loans in 2026 and optimizing your approval chances.

Why APR Matters More Than Interest Rate

APR (Annual Percentage Rate) reflects the total borrowing cost, including interest and lender fees. In 2026, competitive APR ranges in Tier 1 markets typically look like:

- Excellent Credit (750+): 5.49% – 9.99%

- Good Credit (700–749): 8.99% – 14.99%

- Fair Credit (650–699): 14.99% – 24.99%

- Bad Credit (Below 650): 24% – 36%+

Even a 3% difference in APR on a $30,000 loan over five years can result in savings exceeding $2,500–$4,000.

Top Categories of Low APR Personal Loans in 2026

| Loan Type | APR Range | Loan Amount | Best For | Approval Speed |

|---|---|---|---|---|

| Debt Consolidation Loan | 5.99% – 18% | $5,000 – $100,000 | Paying Off Credit Cards | 1–3 Business Days |

| Online Unsecured Loan | 6.49% – 24% | $1,000 – $50,000 | Flexible Use | Same Day |

| Bank Personal Loan | 5.49% – 15% | $3,000 – $75,000 | Existing Customers | 2–5 Days |

| Credit Union Loan | 6% – 18% | $500 – $50,000 | Lower Fees | 2–4 Days |

1. Best Debt Consolidation Loan Providers

Debt consolidation loans are among the highest searched financial products in the USA and UK in 2026. With average credit card APR exceeding 22%, consolidating multiple balances into a 7–12% personal loan can dramatically reduce monthly payments.

Benefits include:

- Lower overall interest cost

- Fixed monthly repayment

- Improved credit utilization ratio

- Single manageable payment

Borrowers with excellent credit and strong income verification qualify for the most competitive rates.

2. Online Lenders with Instant Approval

Fintech lenders dominate 2026’s personal loan market. Advanced AI underwriting allows approval decisions within minutes. Many platforms offer:

- Soft credit check pre-qualification

- Same-day funding

- No collateral requirement

- No prepayment penalties

These lenders are especially attractive for high-income professionals seeking fast liquidity without extensive paperwork.

3. Traditional Bank Personal Loans

Major banks in Tier 1 countries offer some of the lowest APRs for existing customers. Borrowers with strong deposit relationships may qualify for loyalty discounts and autopay rate reductions.

Bank loans often feature:

- Lower maximum APR caps

- Higher borrowing limits

- Relationship-based rate discounts

4. Credit Union Loans

Credit unions typically provide competitive APR caps due to member-focused lending structures. While approval criteria can be stricter, fees are often lower than online lenders.

How to Qualify for the Lowest APR in 2026

- Maintain a credit score above 750

- Keep debt-to-income ratio below 30%

- Provide verifiable stable income

- Apply with a co-signer (if necessary)

- Choose shorter repayment term

Shorter loan terms typically result in lower APR offers, though monthly payments will be higher.

Fixed vs Variable Rate Personal Loans

Most personal loans in Tier 1 markets are fixed-rate, meaning predictable monthly payments. Variable-rate loans may start lower but fluctuate based on benchmark interest rates.

In a rising rate environment, fixed APR loans provide long-term cost stability.

Hidden Fees to Watch in 2026

- Origination fees (1%–8%)

- Late payment penalties

- NSF fees

- Prepayment penalties (rare but possible)

Always compare total repayment cost — not just the advertised interest rate.

Personal Loan vs Credit Card: Which Saves More?

Credit cards in Tier 1 countries often carry 20%–29% APR. Personal loans for prime borrowers may offer sub-10% APR. Consolidating $20,000 from a 24% credit card to a 9% personal loan can save over $3,000 in interest over three years.

High Income Borrowers: Strategic Use of Personal Loans

Affluent borrowers sometimes leverage low APR loans for:

- Business cash flow optimization

- Tax-deductible investment structuring

- Home renovation ROI improvements

- Short-term liquidity while preserving investments

Risks of Personal Loans

While unsecured loans offer flexibility, misuse can harm credit scores and increase debt burden. Responsible borrowing involves:

- Borrowing only what is necessary

- Avoiding loan stacking

- Maintaining emergency savings

2026 Lending Trends in Tier 1 Countries

Key trends shaping personal loans in 2026 include:

- AI-driven risk assessment models

- Increased digital-only lending platforms

- Higher competition lowering APR for prime borrowers

- Flexible repayment customization

Final Verdict: Choosing the Best Low APR Personal Loan

The best personal loan provider in 2026 depends on your credit score, income level, loan purpose, and repayment strategy. Borrowers with excellent credit can secure APRs under 7%, while even fair-credit applicants can reduce borrowing costs through strategic comparison shopping.

By comparing APR, fees, loan terms, and lender reputation, you can potentially save thousands over the lifetime of your loan. Always pre-qualify, review full repayment schedules, and choose lenders that align with your long-term financial strategy.

In Tier 1 markets, competition among lenders is strong — which means informed borrowers have more power than ever. Compare rates carefully and make your borrowing decision strategically in 2026.