Smart Tax Saving Strategies for High Income Earners in 2026 (Legally Reduce Taxes)

Smart Tax Saving Strategies for High Income Earners in 2026 (Legally Reduce Taxes)

For high-income earners in 2026, tax efficiency is no longer optional — it is a strategic necessity. As federal and state tax brackets remain elevated and capital gains, Medicare surtaxes, and net investment income taxes continue to impact affluent households, implementing legal tax saving strategies can protect hundreds of thousands of dollars over a lifetime.

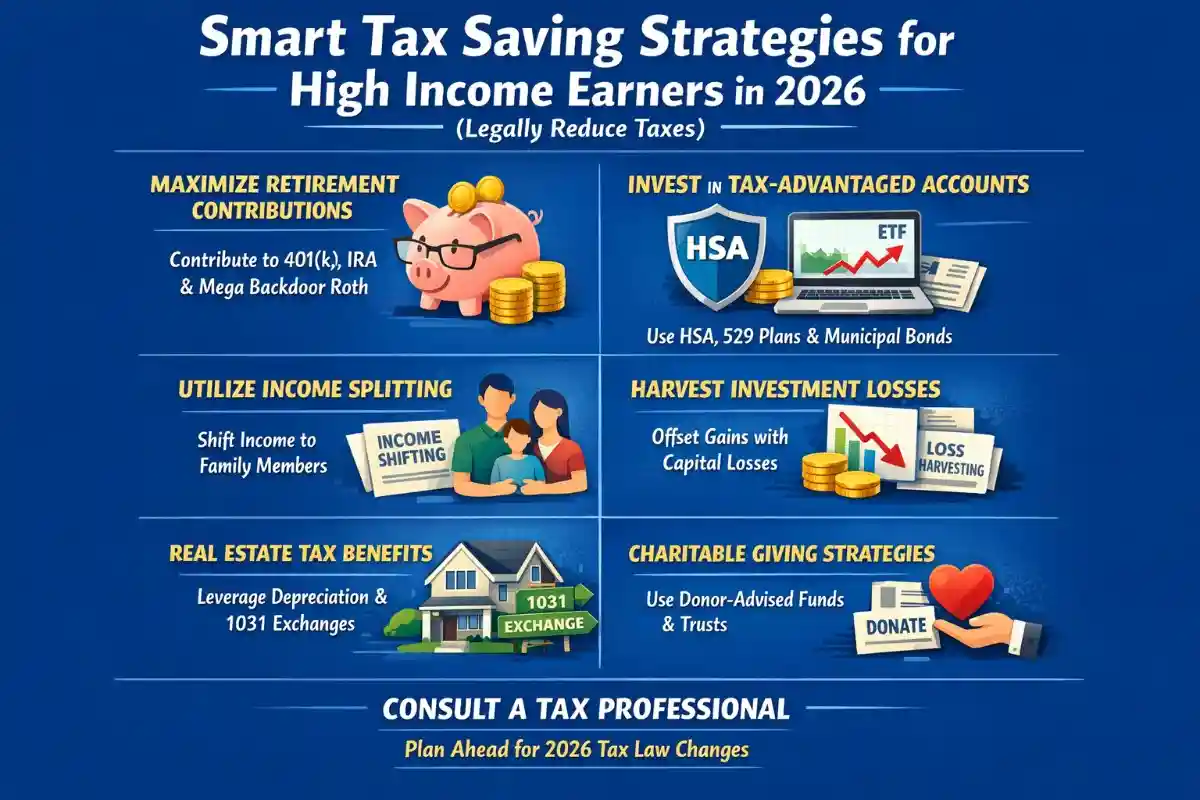

This comprehensive guide covers the most powerful tax reduction strategies for high income earners, including advanced retirement contributions, business entity optimization, real estate deductions, capital gains planning, tax loss harvesting, charitable planning, and asset location strategies.

Whether you're a business owner, executive, physician, tech professional, investor, or high net worth individual, these proven tax planning methods can significantly reduce your taxable income — fully within IRS guidelines.

Understanding the 2026 Tax Landscape for High Earners

High-income earners typically face:

- Top federal income tax brackets (35%–37%)

- State income taxes (up to 13% in some states)

- 3.8% Net Investment Income Tax (NIIT)

- Additional Medicare tax (0.9%)

- Capital gains taxes (15%–20% federal)

Without proactive planning, combined effective tax rates can exceed 45% in high-tax states.

1. Maximize Retirement Contributions (First Line of Defense)

Retirement accounts remain one of the most powerful tools to reduce taxable income.

| Account Type | 2026 Contribution Limit (Estimated) | Tax Benefit |

|---|---|---|

| 401(k) | $23,000+ (plus catch-up) | Pre-tax deduction |

| SEP IRA | Up to 25% of income (cap applies) | Business deduction |

| Solo 401(k) | Employee + Employer contributions | Large tax deferral |

| Defined Benefit Plan | $100,000+ possible | Major income reduction |

High earners with self-employment income can potentially shelter six figures annually through advanced retirement structures.

2. Backdoor Roth IRA Strategy

High earners often exceed Roth IRA income limits. The Backdoor Roth IRA strategy allows after-tax IRA contributions to be converted into Roth accounts, enabling tax-free growth and withdrawals.

This is particularly effective for long-term wealth accumulation and estate planning.

3. Tax Loss Harvesting for Investors

Tax loss harvesting allows investors to offset capital gains by selling underperforming assets.

- Offset unlimited capital gains

- Deduct up to $3,000 against ordinary income annually

- Carry forward unused losses indefinitely

This strategy is widely used by high net worth investors to reduce capital gains tax exposure.

4. Real Estate Tax Advantages

Real estate remains one of the most tax-efficient investment vehicles.

- Depreciation deductions

- 1031 exchanges (defer capital gains)

- Mortgage interest deductions

- Property tax deductions

- Cost segregation studies

| Strategy | Primary Benefit |

|---|---|

| Depreciation | Non-cash tax deduction |

| 1031 Exchange | Defers capital gains taxes |

| Cost Segregation | Accelerates depreciation |

5. S Corporation Election for Business Owners

High-income entrepreneurs may reduce self-employment taxes by electing S-Corp status. This allows income to be split between salary and distributions.

Proper structuring can reduce payroll taxes significantly while remaining compliant.

6. Health Savings Accounts (HSA) – Triple Tax Advantage

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for medical expenses

For high earners with HDHP plans, HSAs function like stealth retirement accounts.

7. Charitable Giving & Donor-Advised Funds

Donor-advised funds (DAFs) allow lump-sum charitable deductions in high-income years while distributing funds over time.

- Immediate tax deduction

- Avoid capital gains on appreciated assets

- Flexible grant timing

8. Capital Gains Planning

Strategic timing of asset sales can reduce tax liability.

- Hold assets over one year for lower long-term rates

- Offset gains with harvested losses

- Consider income threshold timing

9. Asset Location Strategy

Place tax-inefficient investments (bonds, REITs) in tax-advantaged accounts, while keeping tax-efficient index funds in taxable accounts.

10. State Tax Planning & Residency Optimization

High earners in states like California or New York may explore residency planning strategies to reduce state income taxes — where legally applicable.

Advanced Tax Planning Strategies for High Net Worth Individuals

- Grantor Retained Annuity Trusts (GRATs)

- Irrevocable Life Insurance Trusts (ILITs)

- Family Limited Partnerships

- Opportunity Zone Investments

Common Tax Mistakes High Earners Make

- Failing to plan before year-end

- Ignoring estimated tax payments

- Underutilizing retirement accounts

- Not coordinating with CPA & financial advisor

How to Build a Proactive Tax Strategy for 2026

- Conduct mid-year tax projection

- Maximize pre-tax contributions

- Optimize investment structure

- Consult a CPA or tax strategist

- Review quarterly

Final Thoughts – Keep More of What You Earn

Smart tax planning is not about evasion — it’s about strategic, legal optimization. High-income earners who proactively structure retirement contributions, investment allocations, business entities, and charitable planning can reduce their effective tax rate significantly.

Even a 3–5% reduction in effective tax rate can translate into six-figure lifetime savings for high earners.

Pro Tip: Tax planning should happen before December 31 — not in April.

By implementing these advanced tax saving strategies in 2026, you can legally reduce taxes, accelerate wealth accumulation, and protect your financial future.