Private Banking vs Wealth Management – Which Is Better for High Net Worth Individuals?

Private Banking vs Wealth Management – Which Is Better for High Net Worth Individuals?

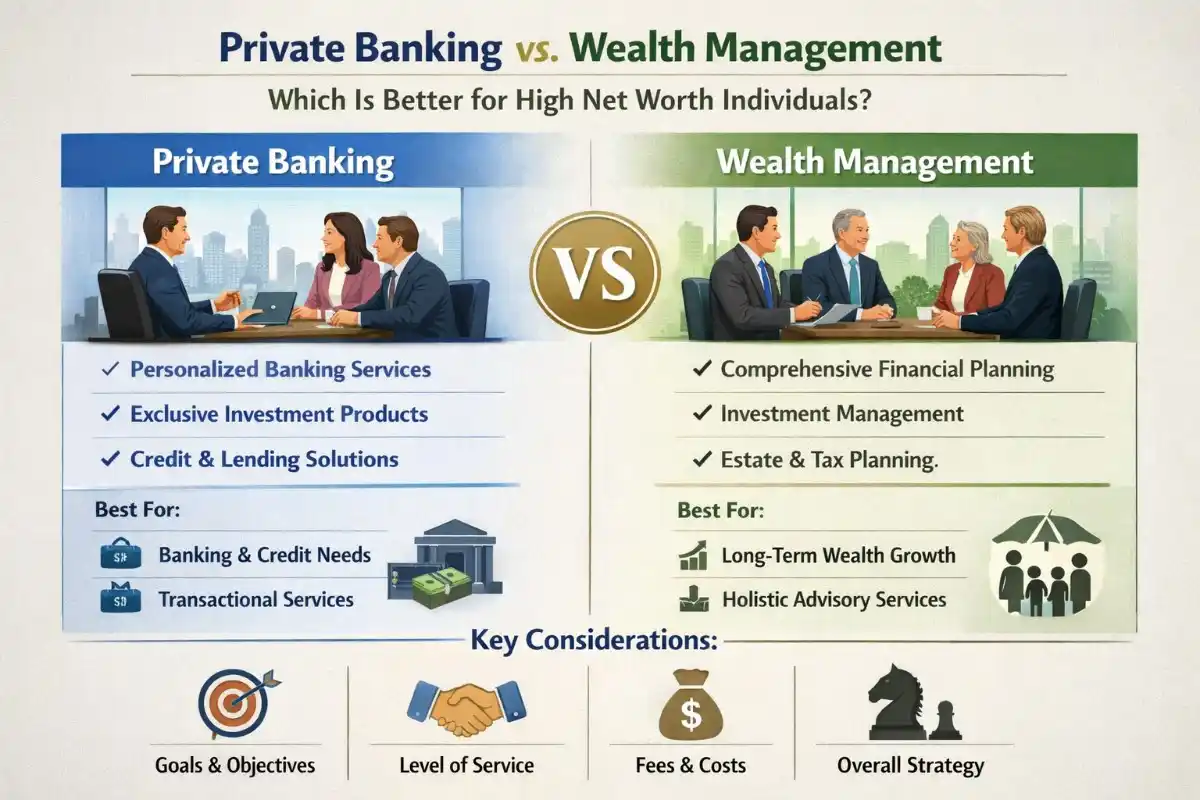

For high net worth individuals (HNWIs) and ultra-high net worth individuals (UHNWIs), choosing between private banking and wealth management is one of the most important financial decisions in 2026. With increasing global tax complexity, rising interest rates, cross-border investments, and evolving estate laws in the United States, United Kingdom, Canada, Australia, Singapore, and the UAE, affluent investors require highly specialized financial guidance.

But which solution delivers more value — private banking services through elite global banks, or independent wealth management firms operating under fiduciary standards?

This in-depth guide compares private banking vs wealth management across investment strategy, tax optimization, estate planning, lending solutions, fee structures, regulatory oversight, and global diversification opportunities — helping you determine the best fit for your net worth, liquidity needs, and long-term legacy planning.

What Is Private Banking?

Private banking is an exclusive financial service offered by major global banks to high-net-worth clients. It combines personalized banking, lending, investment advisory, and concierge-level financial services under one institutional umbrella.

Top global private banks in 2026 include:

- J.P. Morgan Private Bank

- Goldman Sachs Private Wealth Management

- Morgan Stanley Private Wealth

- UBS Global Wealth Management

- Credit Suisse Private Banking

- Citi Private Bank

Private banks typically require minimum investable assets ranging from $1 million to $10 million, with ultra-private tiers starting at $25 million or more.

Core Services Offered by Private Banks

- Discretionary portfolio management

- Structured lending & securities-based loans

- Jumbo mortgages & luxury real estate financing

- Alternative investments (private equity, hedge funds)

- Cross-border wealth structuring

- Trust and estate advisory

- Philanthropic advisory services

- Tax-aware portfolio construction

What Is Wealth Management?

Wealth management is a broader financial advisory service focused on holistic financial planning. It is often delivered by independent Registered Investment Advisors (RIAs) or global advisory firms operating under fiduciary standards.

Leading wealth management firms in Tier 1 markets include:

- Fidelity Wealth Management

- Vanguard Personal Advisor Services

- Charles Schwab Wealth Advisory

- Raymond James Financial Services

- Edward Jones Wealth Management

Minimum investment requirements vary widely — from $250,000 to $5 million — depending on the firm and service tier.

Core Services Offered by Wealth Managers

- Comprehensive financial planning

- Retirement income strategy

- Tax-efficient investing

- Estate planning coordination

- Insurance optimization

- Education planning

- Business succession planning

Private Banking vs Wealth Management: Key Differences

| Feature | Private Banking | Wealth Management |

|---|---|---|

| Minimum Assets | $1M–$25M+ | $250K–$5M+ |

| Primary Focus | Banking + Investing | Financial Planning + Investing |

| Lending Solutions | Extensive | Limited |

| Investment Products | Proprietary + Alternative Funds | Open-architecture ETFs & funds |

| Fee Structure | Asset-based + product spread | Transparent AUM fee (fiduciary) |

| Regulatory Model | Bank-regulated | SEC / FCA / ASIC regulated |

| Ideal For | Ultra High Net Worth | High Net Worth Families |

Investment Strategy Comparison

Private Banking Investment Model

Private banks often provide access to exclusive hedge funds, private equity deals, structured notes, and bespoke portfolio solutions. Many offer direct co-investment opportunities and institutional-grade research teams.

Wealth Management Investment Model

Independent wealth managers typically use diversified ETF portfolios, tax-loss harvesting, and modern portfolio theory strategies to optimize long-term growth while minimizing cost and risk.

Fee Structures Explained

Understanding fee transparency is critical for high-net-worth individuals.

Private Banking Fees

- 0.75%–1.50% AUM fees

- Performance fees on alternatives

- Product commissions or spreads

- Lending interest margins

Wealth Management Fees

- 0.50%–1.25% AUM (tiered)

- No proprietary product bias (in fiduciary firms)

- Flat planning fees (some RIAs)

In 2026, fee transparency has become a major deciding factor for affluent investors concerned about conflicts of interest.

Tax Optimization & Estate Planning

High net worth individuals in the US face federal estate tax exemptions, capital gains exposure, and potential changes in wealth transfer laws. In the UK, inheritance tax (IHT) remains a concern. In Canada and Australia, capital gains realization planning is crucial.

Private banks often have in-house estate attorneys and trust officers. Wealth managers frequently collaborate with external tax attorneys and CPAs while maintaining fiduciary oversight.

Lending & Credit Solutions

This is where private banking clearly excels.

- Securities-based lines of credit (SBLOC)

- Luxury yacht & aircraft financing

- Commercial real estate loans

- Jumbo mortgages with preferential rates

Wealth management firms generally partner with third-party lenders but rarely offer in-house credit facilities.

Family Office Considerations

For ultra-high-net-worth families ($50M+), the decision may expand beyond private banking vs wealth management into establishing a single-family office (SFO) or multi-family office (MFO).

Private banks sometimes offer “outsourced family office” services including consolidated reporting, generational planning, and philanthropy structuring.

Who Should Choose Private Banking?

- Individuals with $10M+ in liquid assets

- Business owners requiring structured lending

- Investors seeking alternative investments

- Families requiring cross-border wealth structuring

Who Should Choose Wealth Management?

- Professionals with $1M–$10M investable assets

- Retirees focused on income planning

- Families prioritizing fiduciary transparency

- Clients seeking lower-cost diversified portfolios

Case Study: $8 Million Portfolio Scenario

A tech executive with $8M in investable assets:

- Private Bank: Access to private equity funds, securities-based credit, estate structuring.

- Wealth Manager: Diversified ETF strategy, tax-loss harvesting, retirement modeling, lower fees.

Decision depends on complexity, risk appetite, and liquidity needs.

Risks to Consider

- Conflicts of interest in proprietary products

- Illiquidity in alternative investments

- Over-concentration risk

- Regulatory differences across jurisdictions

Final Verdict: Which Is Better in 2026?

There is no universal answer. Private banking is ideal for ultra-high-net-worth individuals needing integrated banking, credit, and alternative investments. Wealth management is often superior for high-net-worth families seeking fiduciary advice, tax efficiency, and transparent fees.

In many cases, sophisticated investors use both — a private bank for lending and alternatives, alongside an independent wealth manager for objective portfolio oversight.

Frequently Asked Questions

What net worth qualifies for private banking?

Typically $1M minimum, though elite tiers require $10M–$25M+.

Is wealth management fiduciary?

Independent RIAs operate under fiduciary standards, while bank advisors may operate under suitability standards.

Can I use both services?

Yes, many UHNW individuals maintain private banking relationships while hiring independent wealth managers for oversight.

Disclaimer: This content is for informational purposes only and does not constitute investment, legal, or tax advice. Consult licensed professionals before making financial decisions.