How to Invest in Real Estate with Little Money in 2026 – Beginner’s Guide

How to Invest in Real Estate with Little Money in 2026 – Beginner’s Guide

Real estate remains one of the most powerful wealth-building tools in the United States and other Tier-1 economies. But in 2026, with higher property prices, elevated interest rates, and tighter lending standards, many beginners believe they need tens of thousands of dollars to get started.

The truth? You can invest in real estate with little money — if you use the right strategy.

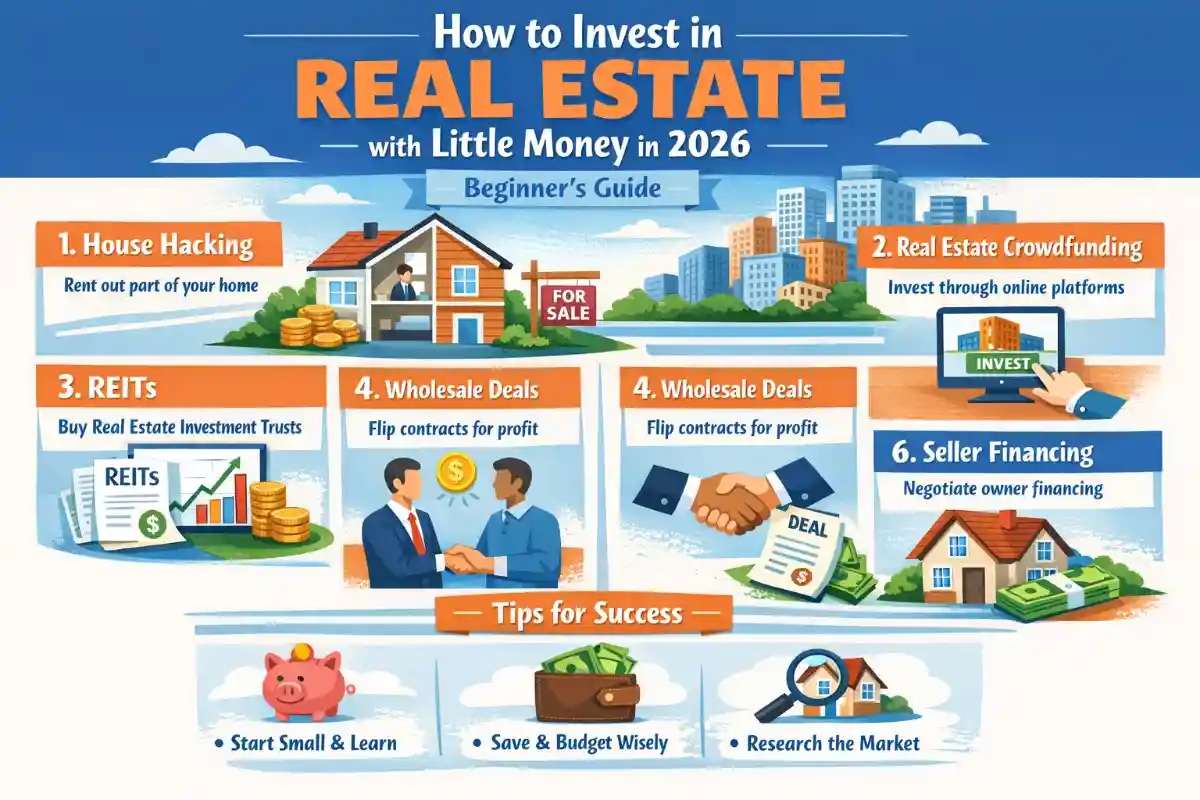

This in-depth beginner’s guide covers the most practical and profitable ways to enter the property market with limited capital. From FHA loans and house hacking to REIT investing, real estate crowdfunding, seller financing, and creative no-money-down strategies, you’ll learn how to build long-term wealth without waiting years to save a massive down payment.

Why Real Estate Is Still a Smart Investment in 2026

- Appreciation over time

- Rental income & cash flow

- Tax advantages (depreciation, deductions)

- Inflation hedge

- Leverage using borrowed money

Unlike stocks, real estate allows you to control a large asset with a relatively small upfront investment — making it uniquely powerful for beginners.

How Much Money Do You Actually Need to Start?

Many first-time investors believe they need 20% down. In reality, several options allow entry with 0%–5% down.

| Strategy | Typical Down Payment | Best For |

|---|---|---|

| FHA Loan + House Hack | 3.5% | First-Time Buyers |

| VA Loan | 0% | Veterans |

| Conventional (Owner-Occupied) | 3%–5% | Primary Residence Investors |

| REIT Investing | $100+ | Passive Investors |

| Crowdfunding | $500–$1,000 | Diversified Investors |

1. House Hacking – Live for Free While Building Equity

House hacking is one of the best beginner-friendly real estate strategies in 2026.

You purchase a multi-unit property (duplex, triplex, fourplex) using an FHA loan with just 3.5% down, live in one unit, and rent out the others. Rental income offsets your mortgage — sometimes covering it entirely.

Why It Works:

- Low down payment

- Owner-occupied loan rates (lower interest)

- Build equity while reducing living expenses

2. FHA Loan Strategy for Beginners

FHA loans allow buyers with moderate credit scores to qualify with low down payments.

- Minimum 3.5% down

- Credit score flexibility

- Competitive fixed rates

Important: You must live in the property for at least one year.

3. Real Estate Investment Trusts (REITs)

If you don’t want to manage tenants, REITs offer exposure to commercial real estate without buying property directly.

- Low minimum investment

- High liquidity (publicly traded)

- Diversified portfolio

REITs often provide dividend yields higher than traditional savings accounts.

4. Real Estate Crowdfunding Platforms

Real estate crowdfunding allows investors to pool money into commercial and residential projects.

| Platform Type | Minimum Investment | Target Returns |

|---|---|---|

| Equity Crowdfunding | $500–$1,000 | 8%–15% |

| Debt Crowdfunding | $1,000+ | 6%–10% |

Always review risk disclosures before investing.

5. Seller Financing & Creative Strategies

In seller financing, the property owner acts as the lender. This can reduce bank qualification hurdles.

- Flexible terms

- Lower closing costs

- Negotiable down payment

6. BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat)

The BRRRR method allows investors to recycle capital after refinancing a renovated property.

- Buy below market value

- Rehab to increase value

- Rent for cash flow

- Refinance based on new value

- Repeat process

7. Partnering with Other Investors

Joint ventures allow you to combine resources with partners who provide capital while you manage operations.

Understanding Investment Property Financing in 2026

| Loan Type | Down Payment | Interest Rate Range |

|---|---|---|

| Owner-Occupied FHA | 3.5% | Market Competitive |

| Conventional Investment | 15%–25% | Slightly Higher |

| Hard Money Loan | 10%–20% | 8%–12% |

Best Cities for Rental Property Investment in 2026

Look for:

- Population growth

- Job market expansion

- Affordable entry prices

- Strong rental demand

Risks of Investing with Little Money

- Limited cash reserves

- Unexpected maintenance costs

- Market downturns

- Vacancy risk

Maintain emergency reserves even when starting small.

Tax Benefits of Real Estate Investing

- Depreciation deductions

- Mortgage interest deduction

- 1031 exchange

- Capital gains advantages

Step-by-Step Plan to Start in 2026

- Check credit score

- Save minimum down payment (3%–5%)

- Get pre-approved

- Analyze rental markets

- Start small (duplex or REIT)

- Reinvest profits

Final Thoughts – Start Small, Think Big

You do not need massive capital to begin investing in real estate in 2026. With low down payment loans, house hacking strategies, REIT investments, crowdfunding platforms, and creative financing, beginners can enter the market strategically.

The key is smart leverage, disciplined analysis, and long-term vision.

Pro Tip: The biggest risk in real estate is waiting too long to start.

With careful planning and the right financing approach, even investors with limited savings can begin building a profitable real estate portfolio in 2026.