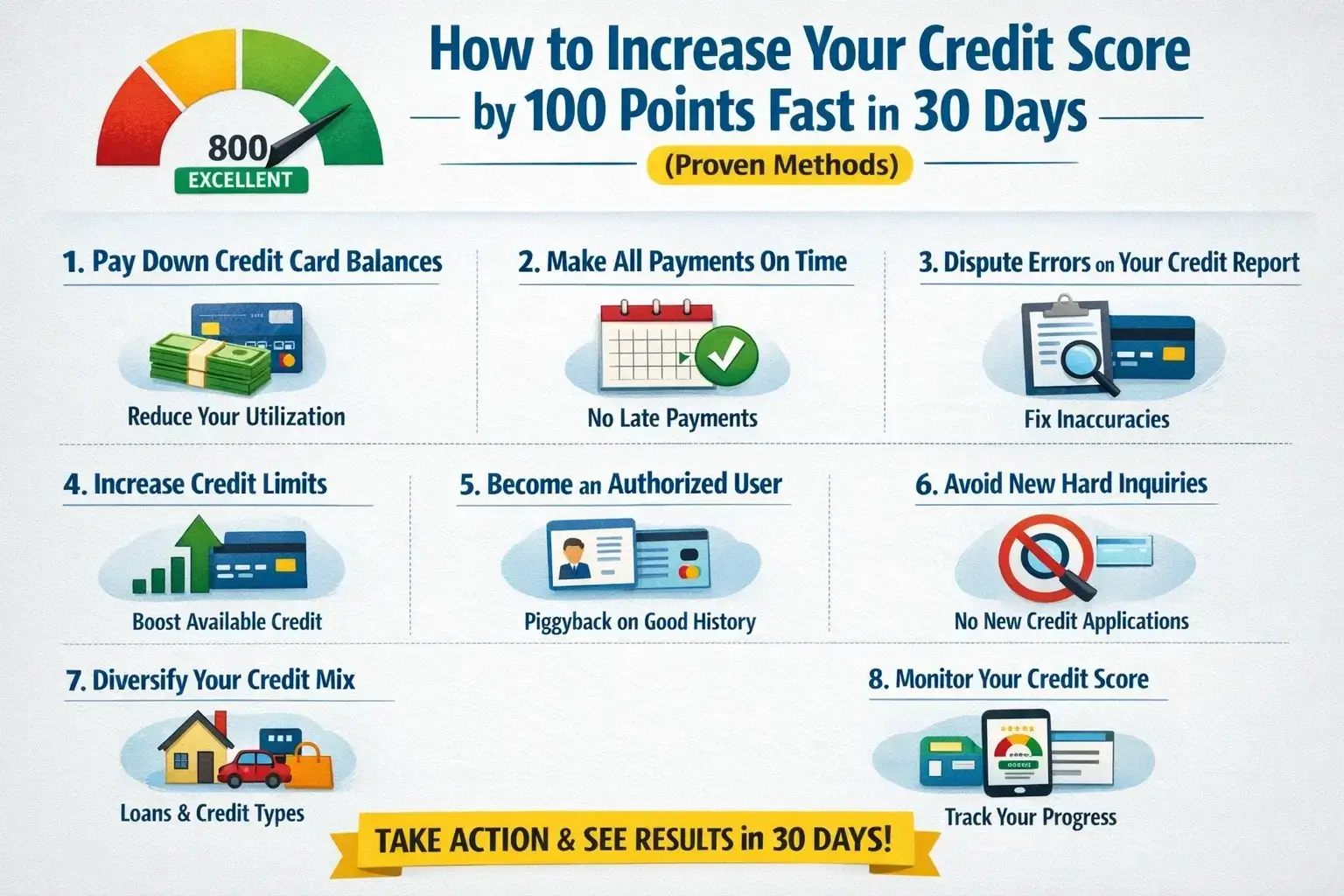

How to Increase Your Credit Score by 100 Points Fast in 30 Days (Proven Methods)

Your credit score is one of the most powerful financial metrics in Tier 1 countries like the United States, United Kingdom, Canada, and Australia. In 2026, lenders use advanced AI-driven underwriting systems that instantly evaluate your creditworthiness when you apply for a personal loan, mortgage refinance, auto loan, high limit credit card, or business credit line.

A 100-point increase in your credit score can mean the difference between a 24% APR and a 7% APR — potentially saving you thousands of dollars over time. While not everyone can boost their score by 100 points in 30 days, many consumers can see dramatic improvements by strategically optimizing key credit factors.

Understanding How Credit Scores Work in 2026

Most lenders in the U.S. rely on FICO and VantageScore models. UK, Canadian, and Australian systems use similar scoring frameworks. The factors remain largely consistent:

| Factor | Weight | Impact on Score |

|---|---|---|

| Payment History | 35% | Late payments cause major drops |

| Credit Utilization | 30% | High balances lower score quickly |

| Length of Credit History | 15% | Older accounts improve stability |

| Credit Mix | 10% | Installment + Revolving improves score |

| New Credit Inquiries | 10% | Too many hard pulls reduce score |

To gain 100 points quickly, you must focus primarily on utilization optimization and correcting reporting errors.

Step 1: Reduce Credit Utilization Below 10%

Credit utilization is the fastest way to increase your score. If your cards are currently at 70% usage, paying them down to below 10% can dramatically improve your score within 30–45 days.

- Pay down high-balance credit cards first

- Request mid-cycle balance reporting from issuer

- Make multiple payments before statement closing date

- Avoid new purchases temporarily

Example: If you have $10,000 total credit limit and $7,000 balance (70% utilization), reducing it to $1,000 (10%) can increase your score significantly.

Step 2: Request Credit Limit Increases

If you cannot pay balances immediately, increasing your total credit limit lowers your utilization ratio instantly.

- Request soft-pull credit line increases

- Update income details with issuer

- Maintain on-time payment history before requesting

High-income earners in Tier 1 markets often qualify for automatic increases, especially on premium credit cards.

Step 3: Dispute Credit Report Errors

According to credit reporting studies, many consumers have inaccurate negative entries. Removing even one incorrectly reported late payment can increase your score by 50–100 points.

- Check all three major credit bureaus

- Dispute inaccuracies online

- Provide documentation proof

- Follow up within 30 days

Step 4: Become an Authorized User

Adding yourself as an authorized user on a seasoned, high-limit, low-utilization credit card can boost your score rapidly. Ensure:

- The primary account holder has perfect payment history

- Low credit utilization (under 10%)

- Long account age (5+ years)

Step 5: Use Rapid Rescoring (Mortgage Applicants)

For mortgage or refinance applicants, rapid rescoring services can update your credit profile within days after balance reductions.

Step 6: Pay Off Collections Strategically

Some newer scoring models ignore paid collections. Negotiating pay-for-delete agreements can significantly improve your profile.

Step 7: Diversify Credit Mix

If you only have credit cards, adding a small credit-builder loan or secured installment loan can improve scoring models.

Step 8: Avoid New Hard Inquiries

Each hard inquiry can reduce your score by 5–10 points. Avoid applying for multiple loans simultaneously.

Step 9: Monitor Your Credit Score Daily

Credit monitoring services help track changes, prevent identity theft, and identify errors quickly.

Step 10: Automate All Payments

Late payments have the biggest negative impact. Set automatic payments for at least minimum due amounts.

30-Day Credit Boost Action Plan

| Week | Action | Expected Impact |

|---|---|---|

| Week 1 | Pull credit reports, dispute errors | Remove negative entries |

| Week 2 | Pay down balances below 30% | Immediate score boost |

| Week 3 | Request credit limit increase | Lower utilization |

| Week 4 | Optimize payments & monitor | Score stabilization |

How a 100-Point Increase Saves Money

Improving your score from 620 to 720 can reduce:

- Mortgage interest rate by 1–2%

- Auto loan APR significantly

- Personal loan interest by thousands

- Insurance premiums in some regions

Common Mistakes to Avoid

- Closing old credit accounts

- Maxing out new cards

- Ignoring small late payments

- Applying for multiple credit cards simultaneously

Can You Really Increase 100 Points in 30 Days?

It depends on your starting point. Consumers with high utilization and minor reporting errors often see the fastest improvements. Those with bankruptcies or severe delinquencies may require longer timelines.

Final Thoughts

Improving your credit score quickly requires strategy, discipline, and accurate information. In 2026’s competitive lending environment, a stronger credit score unlocks lower APR loans, premium credit cards, higher credit limits, and better financial opportunities.

Focus on reducing utilization, correcting errors, maintaining perfect payment history, and leveraging strategic credit optimization techniques. Even if you don’t reach 100 points in 30 days, consistent implementation of these proven methods will position you for long-term financial success.