Home Equity Loan vs HELOC: Which Option Saves You More Money in 2026?

Home Equity Loan vs HELOC: Which Option Saves You More Money in 2026?

With property values remaining strong across Tier 1 markets such as the United States, Canada, the United Kingdom, and Australia, millions of homeowners are sitting on substantial home equity in 2026. If you're considering tapping that equity for renovations, debt consolidation, investment opportunities, or large expenses, two primary options stand out: the Home Equity Loan and the Home Equity Line of Credit (HELOC).

Both allow you to borrow against your home's value, often at lower interest rates than credit cards or unsecured personal loans. But which option saves you more money in 2026? This in-depth guide breaks down rates, repayment structures, risks, tax implications, and real-world cost comparisons to help you decide.

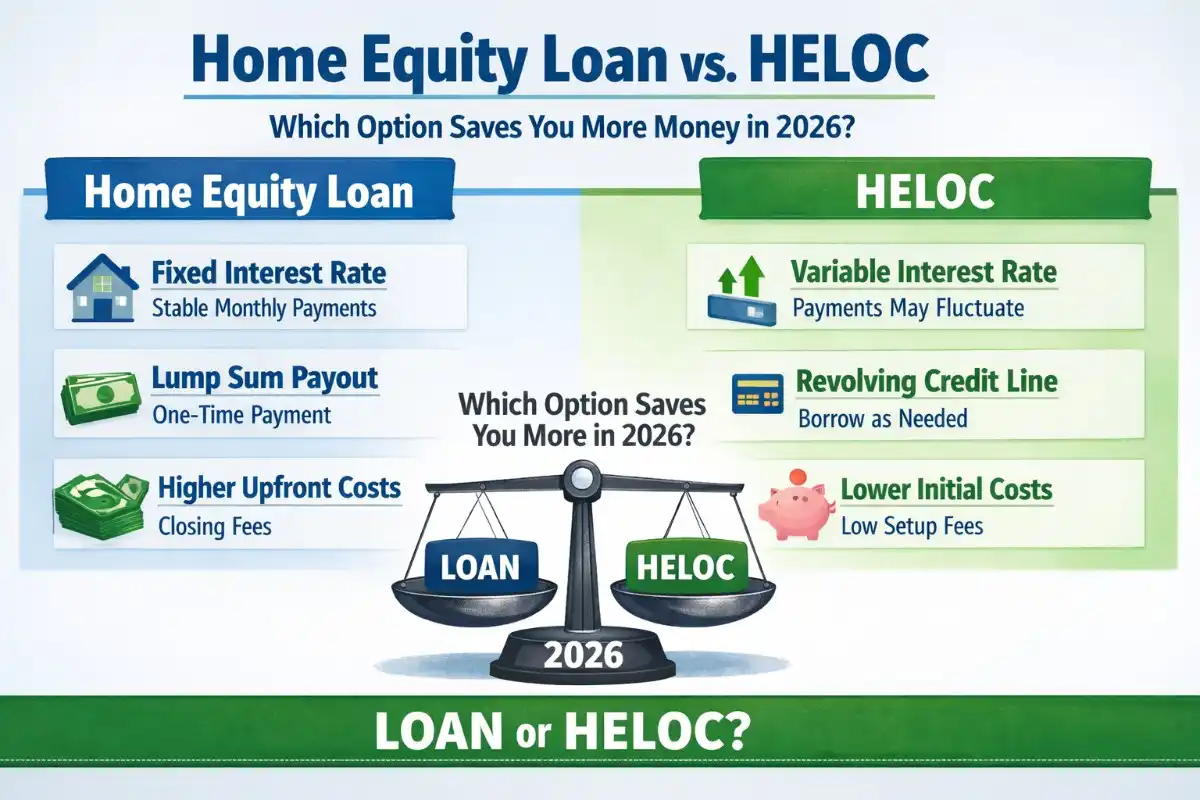

What Is a Home Equity Loan?

A home equity loan is a lump-sum, fixed-rate loan secured by your property. You receive the full amount upfront and repay it over a fixed term, typically 5–30 years.

Key Features

- Fixed interest rate

- Predictable monthly payments

- Structured repayment schedule

- Often lower rates than personal loans

This option works best when you know exactly how much money you need.

What Is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by your home. Instead of receiving funds upfront, you can draw money as needed during the "draw period" (usually 5–10 years).

Key Features

- Variable interest rate (typically)

- Interest-only payments during draw period

- Flexible borrowing structure

- Reusable credit line

HELOCs function similarly to credit cards but usually with significantly lower interest rates.

Current Interest Rate Trends in 2026

Due to higher benchmark rates, home equity borrowing costs in 2026 generally range:

- Home Equity Loans: 6.5% – 9%

- HELOCs: 7% – 10% (variable)

Rates vary by lender, credit score, loan-to-value ratio (LTV), and market conditions.

Top Lenders Offering Home Equity Loans & HELOCs in 2026

| Lender | Product | Rate Type | Best For |

|---|---|---|---|

| Bank of America | HELOC | Variable | Flexible borrowing |

| Wells Fargo | Home Equity Loan | Fixed | Predictable payments |

| Chase | HELOC | Variable | Large credit lines |

| U.S. Bank | Home Equity Loan | Fixed | Competitive fixed rates |

| PNC Bank | Both | Fixed & Variable | Custom repayment options |

Major Lenders in 2026

Leading Tier 1 lenders include:

Cost Comparison: Home Equity Loan vs HELOC

Example Scenario

You borrow $50,000 for a home renovation.

Option 1: Home Equity Loan

- Fixed rate: 7.5%

- Term: 10 years

- Fixed monthly payment

- Total interest paid over life: predictable

Option 2: HELOC

- Variable rate starting at 7%

- Interest-only during 10-year draw

- Rate may increase over time

- Total interest depends on usage and rate changes

If rates rise, HELOC borrowers may pay significantly more over time.

When a Home Equity Loan Saves More Money

- Interest rates are expected to rise

- You need a fixed lump sum

- You prefer stable monthly payments

- You are debt consolidating high-interest credit cards

When a HELOC Saves More Money

- You need flexible access to funds

- Project costs are uncertain

- You plan to repay quickly

- Rates are expected to decline

Tax Deduction Considerations

In the United States, interest on home equity borrowing may be tax deductible if funds are used to buy, build, or substantially improve the home securing the loan (subject to IRS limits).

Always consult a tax advisor before assuming deductibility.

Risks of Home Equity Borrowing

- Your home serves as collateral

- Missed payments risk foreclosure

- Variable rate exposure (HELOC)

- Closing costs may apply

Credit Score & Qualification Requirements

- Minimum credit score: typically 620–680+

- Loan-to-value ratio: usually under 85%

- Stable income verification

- Strong payment history

Borrowers with 740+ credit scores typically receive the lowest rates.

Home Equity Loan vs Cash-Out Refinance

Some homeowners consider refinancing instead. A cash-out refinance replaces your existing mortgage with a larger loan.

In 2026, many homeowners keep their low first-mortgage rates and opt for second-lien equity products instead of refinancing into higher rates.

Strategies to Save the Most Money

- Compare at least 3 lenders

- Negotiate closing costs

- Choose shorter terms if affordable

- Avoid interest-only minimum payments

- Monitor rate caps on HELOCs

Which Option Is Better in 2026?

If rates are high and volatile: A fixed-rate home equity loan provides stability.

If flexibility is your priority: A HELOC may offer better short-term efficiency.

Ultimately, the better option depends on your financial goals, risk tolerance, and repayment timeline.

Final Verdict

In 2026, both Home Equity Loans and HELOCs remain powerful financial tools for homeowners with substantial equity. Leading lenders such as , , , , and offer competitive products.

Before borrowing, carefully calculate total repayment costs, review variable rate risks, and ensure the monthly payment fits comfortably within your budget. Used wisely, home equity financing can unlock value while minimizing borrowing costs compared to unsecured loans.