High Return Investment Options in 2026: ETFs, Index Funds & Dividend Stocks Compared

Investors across the United States, United Kingdom, Canada, and Australia are searching for high return investment options in 2026 that balance growth, passive income, and risk management. With interest rates stabilizing, inflation moderating, and global markets adjusting to new economic cycles, choosing the right investment vehicle is critical for long-term wealth growth.

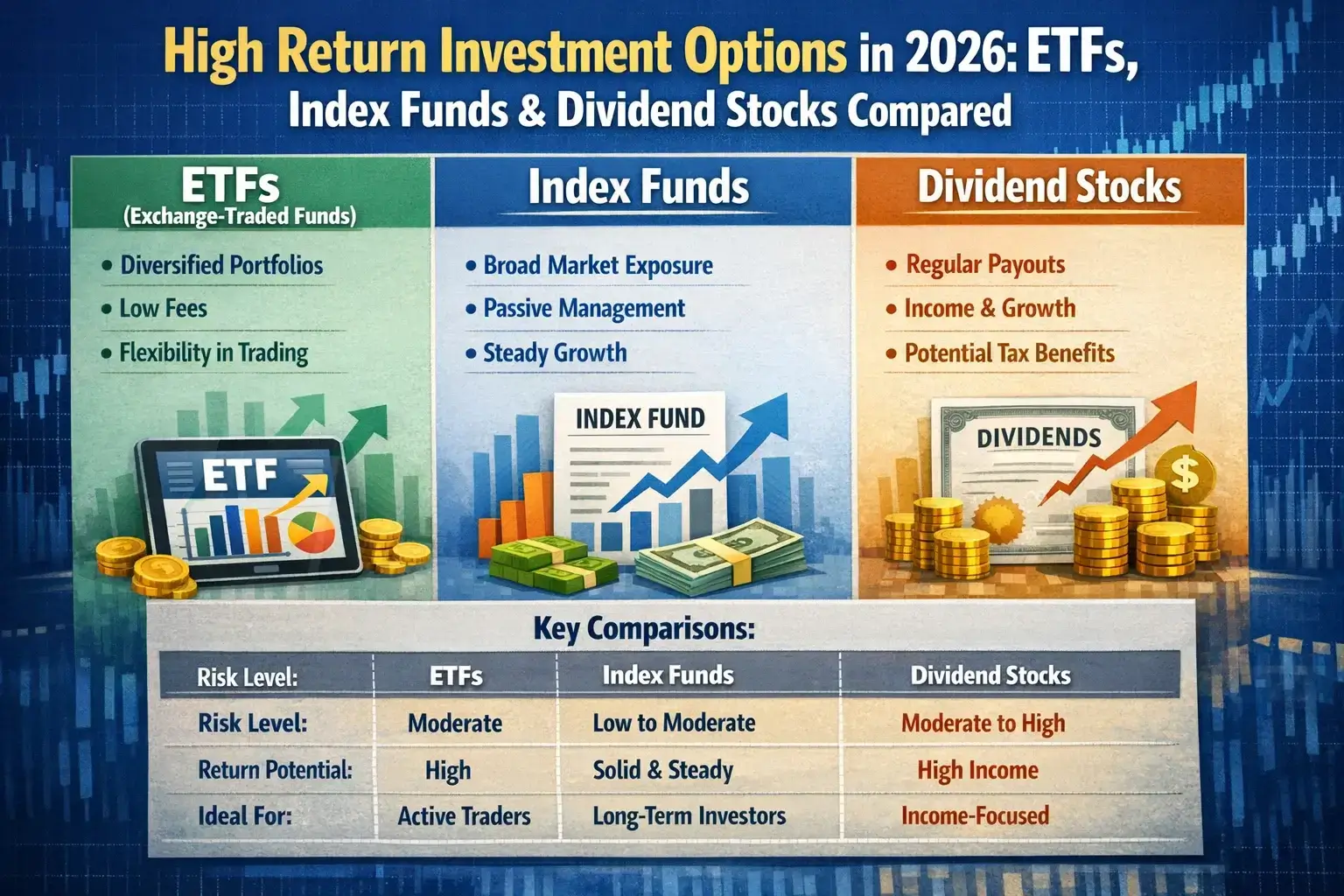

This in-depth 2026 investment guide compares ETFs (Exchange-Traded Funds), Index Funds, and Dividend Stocks based on performance potential, tax efficiency, expense ratios, dividend yield, compounding power, and portfolio diversification benefits.

Why Smart Investing in 2026 Matters More Than Ever

Traditional savings accounts and fixed deposits are no longer sufficient for building long-term wealth. Even high-yield savings accounts often fail to beat inflation consistently. To generate real returns, investors must leverage capital markets strategically.

Key economic trends influencing 2026 investment strategies include:

- Moderating inflation levels

- Shifting central bank interest rate policies

- AI-driven corporate growth

- Global energy transition investments

- Increased retail investor participation

Diversified portfolios using ETFs, index funds, and dividend stocks remain among the most efficient wealth-building tools.

Understanding ETFs (Exchange-Traded Funds)

ETFs are diversified investment funds traded on stock exchanges. They track indices, sectors, commodities, or specific strategies.

Advantages of ETFs

- Low expense ratios

- High liquidity

- Tax efficiency

- Diversification in one trade

- Intraday trading flexibility

Popular ETF Categories in 2026

- S&P 500 ETFs

- Nasdaq-100 Growth ETFs

- Dividend Yield ETFs

- Technology & AI ETFs

- Energy & Clean Tech ETFs

- International Market ETFs

| ETF Type | Avg Annual Return (10Y) | Expense Ratio | Risk Level |

|---|---|---|---|

| S&P 500 ETF | 8–12% | 0.03%–0.09% | Moderate |

| Nasdaq-100 ETF | 10–15% | 0.15%–0.25% | Higher |

| Dividend ETF | 6–10% | 0.06%–0.30% | Moderate |

Index Funds: Long-Term Wealth Builders

Index funds are mutual funds designed to replicate the performance of a market index such as the S&P 500 or FTSE 100.

Benefits of Index Funds

- Passive management

- Very low fees

- Strong long-term track record

- Automatic diversification

- Ideal for retirement accounts

Index funds are especially attractive for retirement planning, 401(k), IRA, ISA (UK), RRSP (Canada), and superannuation (Australia).

| Index Fund Type | Average Historical Return | Best For |

|---|---|---|

| S&P 500 Index Fund | ~10% annually | Long-term growth |

| Total Market Index | 8–10% | Diversification |

| International Index Fund | 6–9% | Global exposure |

Dividend Stocks: Passive Income & Stability

Dividend stocks provide regular income payments while offering potential capital appreciation.

Why Dividend Investing Works

- Consistent cash flow

- Lower volatility compared to growth stocks

- Compound reinvestment potential

- Hedge against inflation

High-yield dividend stocks in sectors like utilities, healthcare, energy, and consumer staples remain popular in 2026.

| Dividend Category | Yield Range | Risk Level |

|---|---|---|

| Blue-Chip Dividend Stocks | 2%–4% | Low |

| High-Yield Stocks | 5%–8% | Moderate |

| Dividend Growth Stocks | 1%–3% | Low–Moderate |

ETFs vs Index Funds vs Dividend Stocks – Direct Comparison

| Feature | ETFs | Index Funds | Dividend Stocks |

|---|---|---|---|

| Liquidity | High | End-of-day pricing | High |

| Expense Ratio | Very Low | Low | None (broker fees) |

| Passive Income | Moderate | Moderate | High |

| Volatility | Moderate | Moderate | Varies |

| Tax Efficiency | High | Moderate | Depends on jurisdiction |

How to Build a High Return Portfolio in 2026

Sample Balanced Portfolio

- 50% S&P 500 ETF or Index Fund

- 20% International ETF

- 20% Dividend Growth Stocks

- 10% Sector-Specific Growth ETF (Technology/AI)

This structure balances capital appreciation with income stability.

Tax Efficiency & Investment Strategy

Tax planning significantly impacts net returns.

- Hold dividend stocks in tax-advantaged accounts

- Use ETFs for taxable brokerage accounts

- Harvest capital losses strategically

- Reinvest dividends for compounding

In the US, long-term capital gains tax rates are lower than short-term rates, encouraging long-term investing.

Risk Management in 2026 Investing

- Diversify across sectors and geographies

- Rebalance portfolio annually

- Avoid emotional trading

- Maintain emergency fund outside investment portfolio

- Invest consistently using dollar-cost averaging

Compound Interest: The Wealth Multiplier

Example: Investing $10,000 annually at 10% average return for 20 years:

| Years | Total Invested | Portfolio Value (10% Return) |

|---|---|---|

| 10 | $100,000 | $159,374 |

| 20 | $200,000 | $630,024 |

This demonstrates the power of long-term disciplined investing.

Common Mistakes Investors Should Avoid

- Chasing short-term trends

- Ignoring expense ratios

- Overconcentrating in one sector

- Timing the market

- Failing to rebalance portfolio

Which Option Is Best for You?

- ETFs: Best for flexibility and tax efficiency

- Index Funds: Ideal for retirement and passive investors

- Dividend Stocks: Suitable for passive income seekers

Most experienced investors combine all three.

Final Thoughts: Smart Investing in 2026

The best high return investment strategy in 2026 is diversified, cost-efficient, tax-aware, and long-term focused. ETFs, index funds, and dividend stocks each serve unique roles in building sustainable wealth.

Action Steps:

- Open a low-cost brokerage account

- Define financial goals

- Create diversified allocation

- Automate monthly investments

- Review portfolio annually

By combining disciplined investing with strategic asset allocation, investors can maximize returns while minimizing unnecessary risk.

Disclaimer: Investments involve market risk. Always conduct personal research or consult a licensed financial advisor before investing.