Best Private Health Insurance Plans for Families in 2026 (Low Premium Options)

Healthcare costs continue to rise across Tier 1 countries including the United States, United Kingdom, Canada, and Australia. For families, medical expenses such as hospital stays, maternity care, pediatric visits, emergency treatment, prescription drugs, and specialist consultations can quickly reach thousands of dollars annually. That’s why choosing the best private health insurance plan for families in 2026 is not just a financial decision — it’s a long-term wealth protection strategy.

This comprehensive 2026 guide covers everything you need to know about low premium family health insurance plans, PPO vs HMO options, deductible strategies, tax-advantaged health savings accounts (HSA), private medical insurance comparison tools, and how to save up to $5,000+ per year on healthcare costs.

Why Private Health Insurance Is Critical for Families in 2026

Even in countries with public healthcare systems, private health insurance provides faster access to specialists, shorter waiting times, broader hospital networks, and coverage for services not included in government programs.

- Access to top-tier hospitals and private clinics

- Lower out-of-pocket medical expenses

- Comprehensive maternity and newborn coverage

- Prescription drug coverage

- Dental and vision add-ons

- International coverage options

In the United States especially, medical debt remains one of the leading causes of bankruptcy. A strong family health insurance plan acts as financial protection against catastrophic healthcare costs.

Best Types of Private Family Health Insurance Plans in 2026

| Plan Type | Best For | Monthly Premium (Family Avg) | Flexibility | Out-of-Pocket Risk |

|---|---|---|---|---|

| HMO | Low premium seekers | $950–$1,200 | Low | Moderate |

| PPO | Specialist access | $1,200–$1,650 | High | Lower |

| HDHP + HSA | Tax-saving families | $800–$1,100 | Moderate | Higher deductible |

| EPO | Balanced flexibility | $1,000–$1,400 | Medium | Moderate |

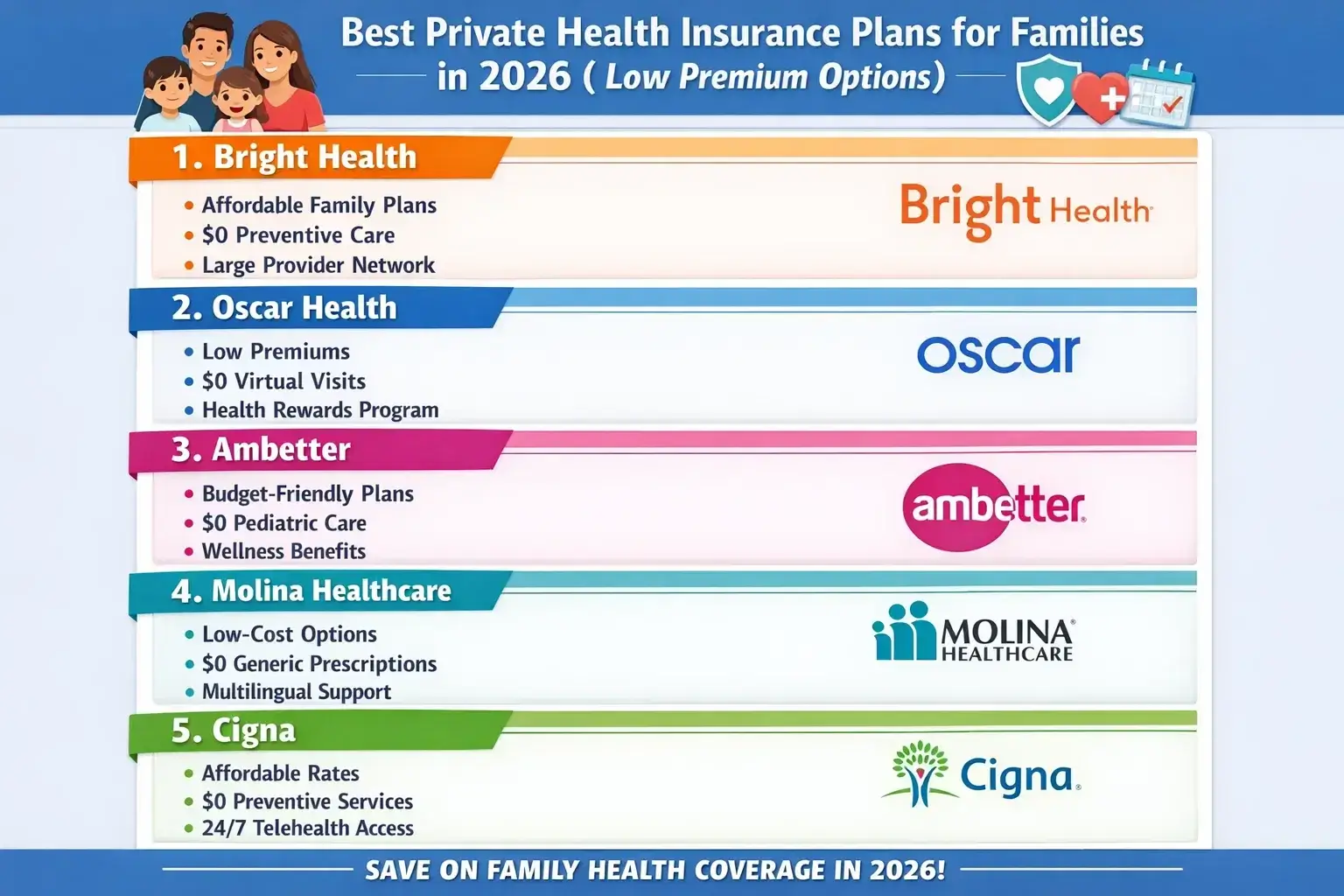

Top Private Health Insurance Providers for Families in 2026

While pricing varies by location, age, and health history, the following providers consistently rank among the best for family coverage:

- Blue Cross Blue Shield (Extensive PPO networks)

- UnitedHealthcare (Comprehensive family benefits)

- Aetna (Affordable HMO & HDHP plans)

- Cigna (International coverage options)

- Kaiser Permanente (Low premium HMO plans)

Always compare at least 3–5 providers using an online health insurance comparison tool before enrolling.

How to Compare Family Health Insurance Plans Online

Step 1: Evaluate Monthly Premium

Premium is the monthly payment. Lower premiums often mean higher deductibles.

Step 2: Understand Deductible Structure

Family deductibles can range from $2,000 to $10,000 annually.

Step 3: Check Out-of-Pocket Maximum

This is the maximum you pay annually before insurance covers 100% of eligible costs.

Step 4: Review Network Coverage

Ensure your preferred pediatrician, OB-GYN, and hospitals are in-network.

Step 5: Compare Prescription Drug Formularies

Medication tiers significantly impact family healthcare costs.

How to Save Thousands on Family Health Insurance in 2026

1. Use a High Deductible Health Plan (HDHP) with HSA

HSAs offer triple tax advantages:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for medical expenses

2. Apply for ACA Subsidies (USA)

Depending on household income, families may qualify for premium tax credits.

3. Bundle Dental & Vision

Bundled coverage often reduces standalone policy costs.

4. Compare Every Year During Open Enrollment

Insurance rates change annually. Loyalty rarely saves money.

5. Choose Generic Medications

Generic drugs significantly reduce pharmacy expenses.

Maternity & Pediatric Coverage in 2026

For growing families, maternity coverage is crucial. Look for:

- Prenatal visits

- Labor & delivery coverage

- NICU coverage

- Newborn care

- Vaccination programs

Comprehensive maternity coverage can prevent $15,000–$25,000 in hospital expenses without insurance.

Private Health Insurance for Self-Employed Families

Self-employed individuals often pay higher premiums. Strategies to reduce costs:

- Deduct premiums as business expense (where applicable)

- Use HDHP + HSA strategy

- Compare marketplace vs private insurers

- Join professional associations for group plans

International Family Health Insurance Options

Families living abroad or relocating frequently should consider international private medical insurance (IPMI). Benefits include:

- Global hospital access

- Medical evacuation coverage

- Multi-country validity

- Flexible deductible options

Common Mistakes Families Make When Choosing Health Insurance

- Choosing lowest premium without analyzing deductible

- Ignoring network restrictions

- Overlooking prescription coverage

- Not calculating total annual healthcare spending

- Failing to review out-of-pocket maximum limits

Real Example: Cost Comparison Scenario

| Plan Type | Annual Premium | Deductible | Total Medical Cost (Example Year) | Total Paid by Family |

|---|---|---|---|---|

| Low Premium HDHP | $10,800 | $8,000 | $12,000 | $16,800 |

| Mid PPO Plan | $15,600 | $3,000 | $12,000 | $18,600 |

The best choice depends on expected healthcare usage and tax strategy.

Tax Benefits of Family Health Insurance

- Premium tax credits (ACA)

- HSA contributions reduce taxable income

- Self-employed premium deductions

- Flexible Spending Accounts (FSA)

Optimizing tax strategy can reduce net healthcare costs significantly.

2026 Trends in Private Family Health Insurance

- Telemedicine coverage expansion

- Mental health coverage improvements

- AI-based health risk assessment pricing

- Preventive care incentives

- Wellness-based premium discounts

Final Thoughts: Choosing the Right Plan for Your Family

The best private health insurance plan for families in 2026 balances premium affordability, deductible strategy, network access, and long-term financial security.

To summarize:

- Compare at least 3–5 providers

- Calculate total annual cost (premium + deductible)

- Check network hospitals and doctors

- Maximize tax advantages (HSA/FSA)

- Review annually during open enrollment

Healthcare inflation continues to rise. Proactively comparing private health insurance plans can save families thousands of dollars per year while ensuring access to quality medical care.

Frequently Asked Questions (FAQ)

What is the cheapest private health insurance for families in 2026?

High Deductible Health Plans (HDHP) combined with HSA accounts often offer the lowest premiums, but suitability depends on expected medical usage.

Is PPO better than HMO for families?

PPO offers more flexibility and specialist access but costs more. HMO plans are cheaper but require network restrictions.

Can families get government subsidies?

In the US, families may qualify for ACA premium tax credits depending on income level.

How often should I switch health insurance?

Review and compare every year during open enrollment to ensure competitive pricing.

Bottom Line: The right private health insurance plan protects your family’s health and finances. Compare quotes, optimize deductibles, and leverage tax benefits to secure affordable coverage in 2026.