Best Mortgage Lenders in 2026: Compare Fixed vs Adjustable Rates Before You Apply

Mortgage lending remains one of the highest-value financial sectors in Tier 1 countries including the United States, United Kingdom, Canada, and Australia. In 2026, competition among banks, digital lenders, and credit unions has intensified, giving borrowers more options than ever when comparing fixed-rate mortgages, adjustable-rate mortgages (ARMs), jumbo loans, FHA loans, VA loans, and refinance products.

Choosing the right mortgage lender and loan structure can save you tens of thousands of dollars over the life of your loan. With interest rate volatility and evolving underwriting standards, understanding the difference between fixed and adjustable rates is essential before submitting your mortgage application.

Mortgage Market Overview in 2026

In 2026, mortgage rates are influenced by central bank policy, inflation trends, bond market yields, and global economic stability. Average ranges in Tier 1 markets typically fall within:

- 30-Year Fixed Mortgage: 5.75% – 7.25%

- 15-Year Fixed Mortgage: 4.99% – 6.25%

- 5/1 Adjustable Rate Mortgage (ARM): 4.75% – 6.50%

- Jumbo Loans: 6.00% – 7.75%

- Refinance Rates: Similar to purchase rates depending on equity

Borrowers with excellent credit (740+), strong income verification, and low debt-to-income ratios qualify for the most competitive APR offers.

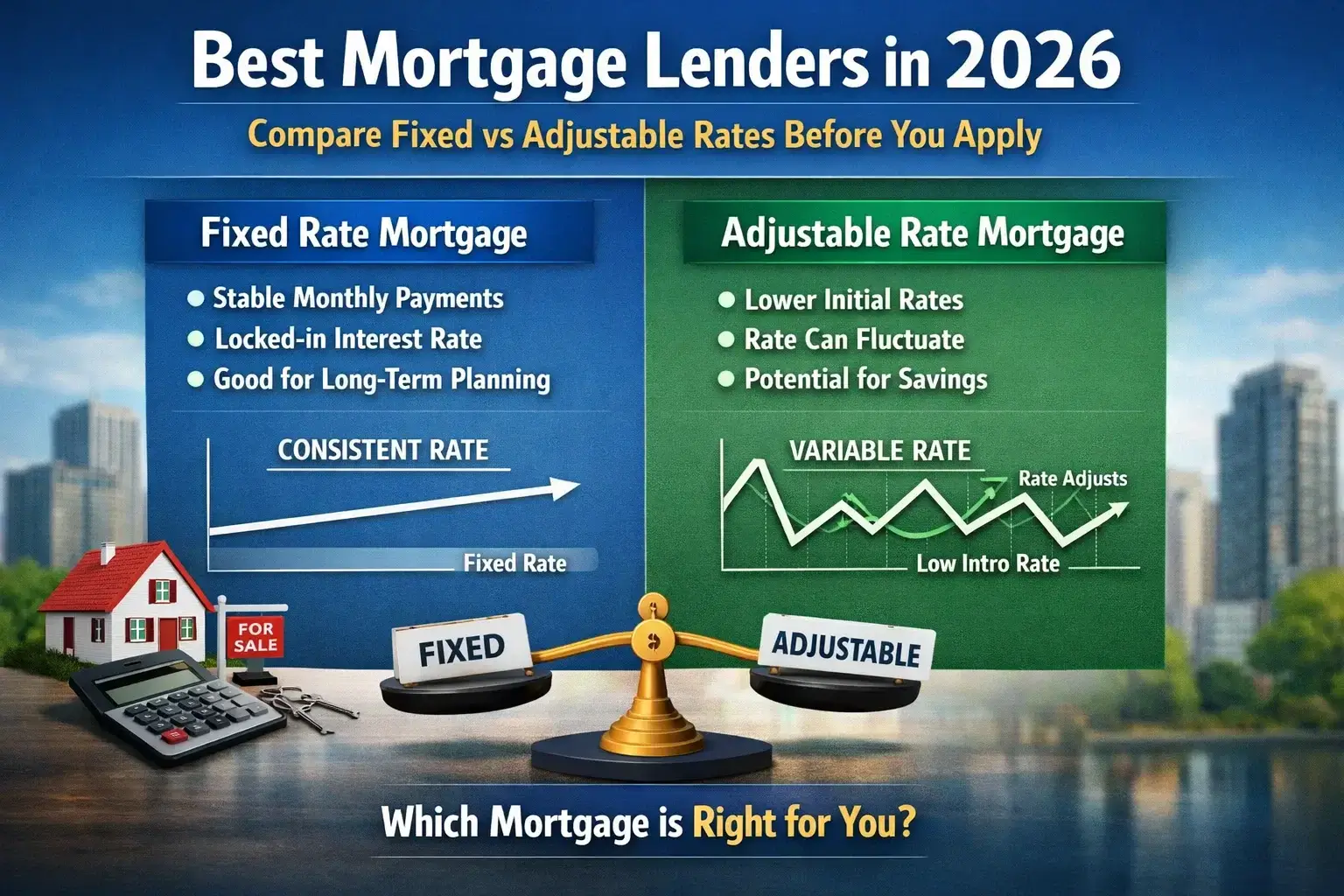

Fixed-Rate Mortgage Explained

A fixed-rate mortgage locks in your interest rate for the entire loan term. This means predictable monthly payments regardless of market changes.

Advantages:

- Stable monthly payments

- Protection from rising interest rates

- Ideal for long-term homeowners

- Easier budgeting

Disadvantages:

- Higher initial rate compared to ARM

- Less flexibility if rates decline

Adjustable-Rate Mortgage (ARM) Explained

An adjustable-rate mortgage offers a lower initial rate for a fixed period (e.g., 5, 7, or 10 years), then adjusts periodically based on market index rates.

Advantages:

- Lower starting APR

- Potential short-term savings

- Ideal for short-term property ownership

Disadvantages:

- Payment uncertainty after adjustment

- Exposure to interest rate increases

Fixed vs Adjustable Mortgage Comparison

| Feature | Fixed Rate | Adjustable Rate (ARM) |

|---|---|---|

| Initial Interest Rate | Moderate | Lower |

| Rate Stability | Guaranteed | Variable After Intro Period |

| Best For | Long-Term Homeowners | Short-Term Buyers |

| Risk Level | Low | Moderate to High |

| Budget Predictability | High | Lower After Adjustment |

Top Mortgage Loan Types in 2026

1. Conventional Loans

Best for borrowers with strong credit and stable income. Down payments typically start at 3–5%.

2. FHA Loans

Government-backed loans for borrowers with lower credit scores. Down payments as low as 3.5%.

3. VA Loans

Available to eligible military service members. Often require no down payment.

4. Jumbo Loans

For high-value properties exceeding conforming loan limits. Typically require strong financial profiles.

Mortgage Refinance in 2026

Refinancing remains popular among homeowners seeking:

- Lower interest rates

- Cash-out equity access

- Shorter loan terms

- Switching from ARM to fixed-rate

Even a 1% reduction in interest can save $40,000+ over a 30-year term depending on loan size.

How to Qualify for the Lowest Mortgage APR

- Maintain credit score above 740

- Keep debt-to-income ratio under 36%

- Provide full income documentation

- Save for larger down payment (20% preferred)

- Compare at least 3 lenders

Hidden Mortgage Costs to Watch

- Origination fees

- Private mortgage insurance (PMI)

- Appraisal fees

- Closing costs (2–5% of loan)

- Prepayment penalties (rare but possible)

Mortgage APR vs Interest Rate

APR includes lender fees and additional costs, making it a more accurate representation of total borrowing expense. Always compare APR, not just advertised interest rate.

Tier 1 Country Mortgage Trends in 2026

- Digital-first mortgage approval systems

- AI-powered underwriting

- Faster refinance processing

- Flexible ARM structures

- Increased competition among online lenders

Should You Choose Fixed or Adjustable in 2026?

If you plan to stay in your home for more than 7–10 years, a fixed-rate mortgage offers long-term stability. If you anticipate relocating or refinancing within a few years, an ARM could provide initial savings.

Final Verdict

Choosing the best mortgage lender in 2026 requires careful comparison of rates, loan terms, lender reputation, and total cost structure. Whether selecting a fixed-rate mortgage for stability or an adjustable-rate mortgage for short-term savings, understanding your financial goals is critical.

With mortgage competition strong in Tier 1 markets, informed borrowers can secure favorable APRs, optimize loan structure, and potentially save tens of thousands over the life of their home loan.

Before applying, compare offers, review full amortization schedules, and ensure the mortgage aligns with your long-term financial strategy.