Best High-Yield Savings Accounts in 2026 – Earn Up to 5% APY Safely

Best High-Yield Savings Accounts in 2026 – Earn Up to 5% APY Safely

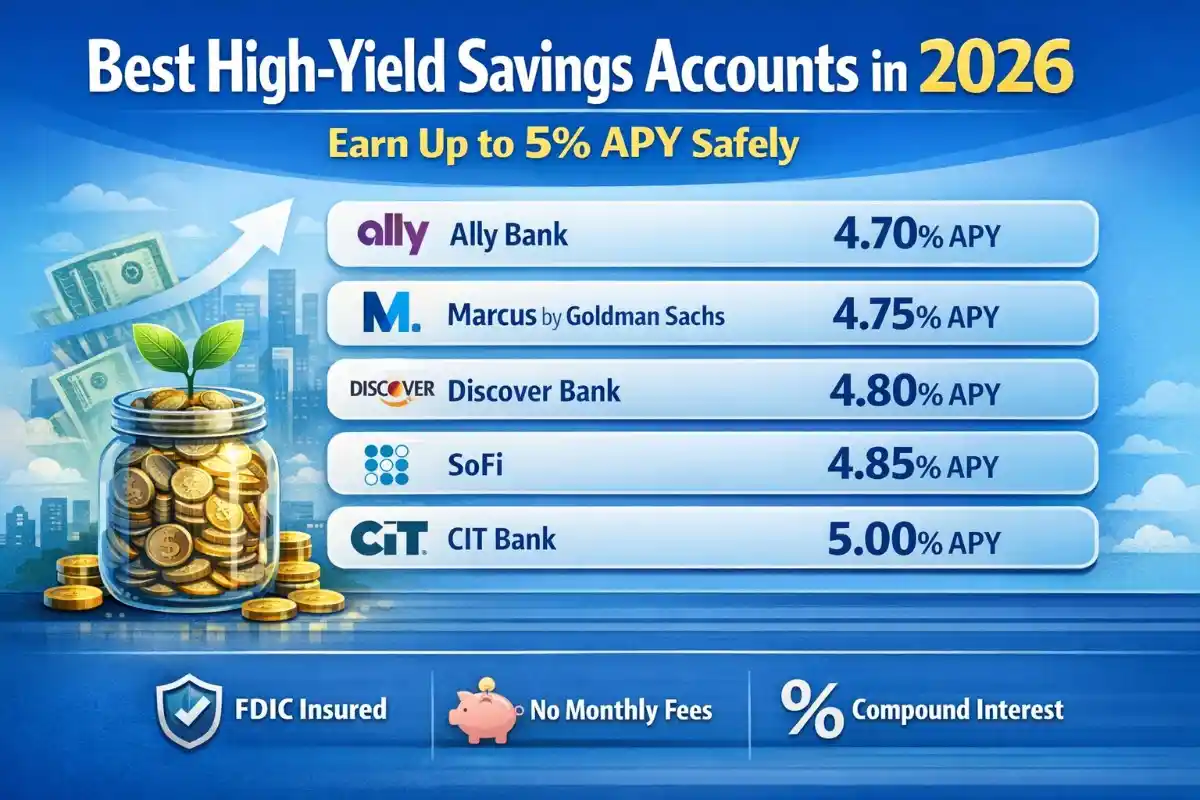

In 2026, high interest rates have created one of the most attractive environments in decades for savers. While traditional brick-and-mortar banks still offer minimal returns, many online banks now provide high-yield savings accounts with APYs reaching up to 5% — all while remaining FDIC-insured and fully secure.

If you are looking for a safe place to grow your emergency fund, short-term savings, or idle cash reserves, this guide covers the best high-yield savings accounts in 2026, comparing APYs, fees, minimum balance requirements, and key features from top Tier 1 financial institutions.

What Is a High-Yield Savings Account?

A high-yield savings account (HYSA) is a deposit account that offers a significantly higher Annual Percentage Yield (APY) compared to traditional savings accounts.

Unlike stocks or crypto investments, these accounts are:

- FDIC-insured (up to $250,000 per depositor in the U.S.)

- Low risk

- Highly liquid

- Ideal for emergency funds and short-term savings

In 2026, many top online banks are offering rates between 4.25% and 5.00% APY.

Best High-Yield Savings Accounts in 2026

| Bank | APY (Up To) | Minimum Deposit | Monthly Fee | FDIC Insured |

|---|---|---|---|---|

| Ally Bank | 4.75% | $0 | $0 | Yes |

| Marcus by Goldman Sachs | 4.90% | $0 | $0 | Yes |

| SoFi Bank | 5.00% | $0 | $0 | Yes |

| American Express National Bank | 4.80% | $0 | $0 | Yes |

| Discover Online Savings | 4.70% | $0 | $0 | Yes |

1. Ally Bank – Best Overall Flexibility

remains a leader in online banking with competitive APYs and zero fees.

Why Choose Ally?

- No minimum balance

- No monthly maintenance fees

- 24/7 customer support

- Savings buckets for goal tracking

Ally is ideal for savers who want flexibility and user-friendly digital tools.

2. Marcus by Goldman Sachs – Strong APY & Simplicity

operates Marcus, a popular high-yield savings platform.

- Competitive APY near 5%

- No fees

- No minimum deposit

- Easy online account setup

Marcus is especially popular among conservative savers seeking brand reliability.

3. SoFi Bank – Highest Promotional APY

frequently advertises some of the highest APYs in 2026.

- Up to 5.00% APY (with qualifying direct deposit)

- Checking + savings combo benefits

- No account fees

- FDIC insurance coverage

This is an excellent option for those willing to meet direct deposit requirements.

4. American Express National Bank – Trusted Brand

offers a straightforward high-yield savings product.

- Competitive APY

- No monthly fees

- Strong customer service reputation

5. Discover Online Savings – Reliable & Secure

continues to provide stable high-yield savings accounts.

- No minimum deposit

- No monthly fees

- Consistent rate updates

How Much Can You Earn at 5% APY?

Example growth on $10,000:

- At 0.50% APY: ~$50 per year

- At 5.00% APY: ~$500 per year

That’s a 10x increase in interest earnings compared to traditional banks.

Why Online Banks Offer Higher APYs

- Lower overhead costs

- No physical branches

- Digital-first operations

- Competitive rate environment

Are High-Yield Savings Accounts Safe?

Yes — as long as the bank is FDIC insured (in the U.S.) or protected by similar government schemes in Tier 1 countries:

- United States: FDIC insurance up to $250,000

- Canada: CDIC protection

- United Kingdom: FSCS protection

- Australia: Financial Claims Scheme

High-Yield Savings vs Money Market Accounts

High-Yield Savings

- Higher APY

- No check-writing

- Ideal for emergency funds

Money Market Accounts

- Slightly lower APY (sometimes)

- Limited check-writing ability

- Higher minimum balance requirements

Tips to Maximize Your Savings in 2026

- Move idle cash from low-interest accounts

- Automate monthly deposits

- Monitor APY changes quarterly

- Take advantage of promotional offers

Common Mistakes to Avoid

- Ignoring APY drops after promo periods

- Keeping large cash in 0.01% traditional banks

- Exceeding FDIC insurance limits

- Confusing APY with APR

Who Should Open a High-Yield Savings Account?

- Anyone building an emergency fund

- Individuals saving for home down payments

- Business owners holding short-term reserves

- Investors seeking safe cash parking options

Final Thoughts

The best high-yield savings accounts in 2026 combine competitive APY rates near 5%, zero fees, and strong digital banking experiences. Leading institutions like , , , , and continue to lead the market.

In a high-rate environment, there is little reason to leave money earning less than 1%. By choosing a top-tier online savings account, you can safely earn up to 5% APY while maintaining full liquidity and government-backed protection.