Best Fixed & Indexed Annuity Rates in 2026 – Guaranteed Retirement Income Guide

Best Fixed & Indexed Annuity Rates in 2026 – Guaranteed Retirement Income Guide

As interest rates remain elevated and market volatility continues to challenge retirees, fixed and indexed annuities have become some of the most searched financial products in the United States, Canada, the UK, and Australia. In 2026, high-yield fixed annuities and competitive fixed indexed annuities (FIAs) are offering some of the strongest guaranteed returns seen in over a decade.

If you're looking for guaranteed retirement income, tax-deferred growth, and principal protection, this comprehensive 2026 annuity guide will help you compare the best options available today. We’ll break down top providers, current rate trends, income rider strategies, and expert planning tactics to help you maximize your long-term retirement wealth.

Why Fixed & Indexed Annuities Are Surging in 2026

In a high-inflation, high-interest environment, conservative investors are increasingly prioritizing capital preservation and predictable income. Unlike stocks, bonds, or crypto assets, annuities provide:

- ✔ Guaranteed minimum returns

- ✔ Tax-deferred compounding

- ✔ Protection from market losses

- ✔ Optional lifetime income riders

- ✔ Estate planning benefits

In 2026, multi-year guaranteed annuities (MYGAs) are offering rates above many traditional savings accounts and CDs, while indexed annuities provide upside growth potential linked to market indices like the S&P 500 — without direct market risk.

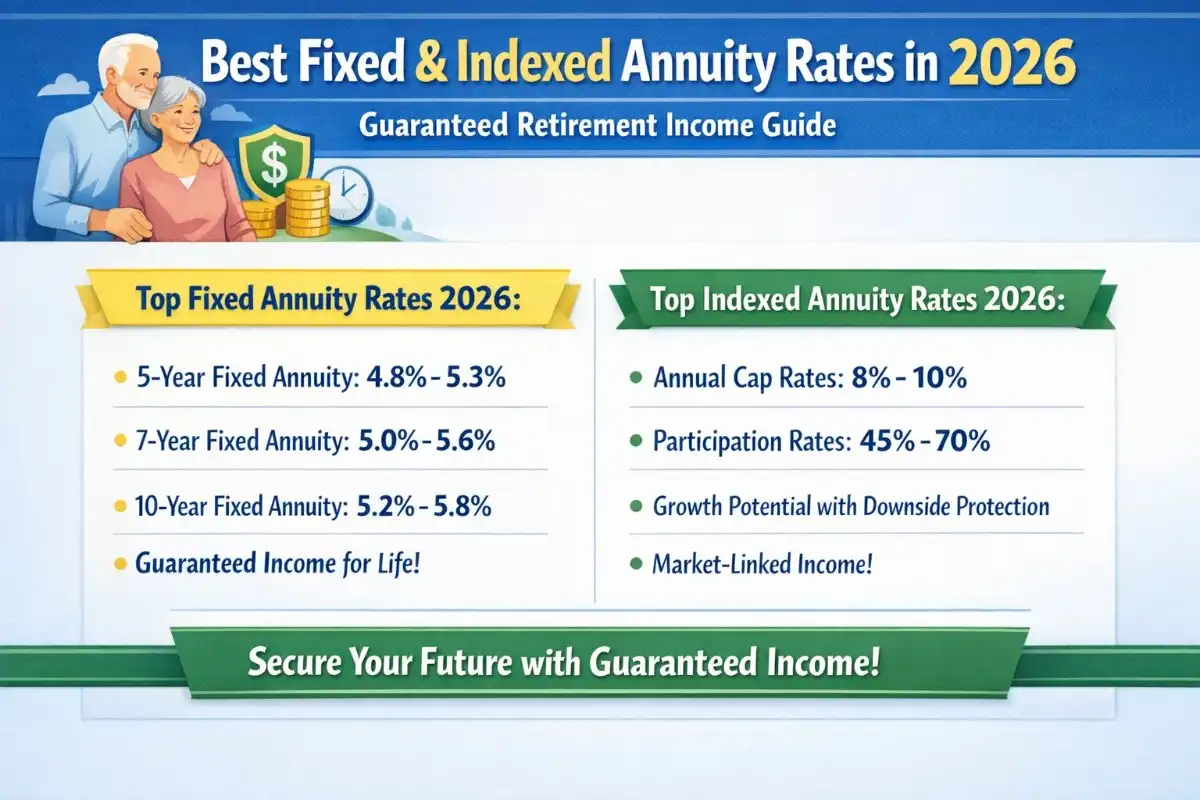

Best Fixed Annuity Rates in 2026 (MYGA Comparison)

| Insurance Provider | Term Length | Guaranteed Rate (2026) | Minimum Premium | AM Best Rating |

|---|---|---|---|---|

| MassMutual | 5 Years | 5.75% | $10,000 | A++ |

| New York Life | 7 Years | 5.60% | $10,000 | A++ |

| Allianz Life | 5 Years | 5.50% | $5,000 | A+ |

| Prudential | 3 Years | 5.25% | $25,000 | A+ |

| Pacific Life | 5 Years | 5.45% | $10,000 | A+ |

Note: Rates vary by state and contract. Always request an updated annuity rate sheet before purchasing.

Best Fixed Indexed Annuities (FIA) in 2026

Fixed indexed annuities combine principal protection with growth potential tied to a stock market index. Instead of earning a fixed rate, returns depend on caps, spreads, and participation rates.

| Provider | Index Option | Participation Rate | Cap Rate | Income Rider Bonus |

|---|---|---|---|---|

| Allianz Life | S&P 500 | 100% | 8.50% | 20% Bonus |

| Nationwide | NASDAQ-100 | 110% | Uncapped | 25% Bonus |

| Lincoln Financial | Hybrid Volatility Index | 125% | Spread-Based | 15% Bonus |

| American Equity | S&P 500 | 100% | 9.00% | 20% Bonus |

Understanding Fixed vs Indexed Annuities

Fixed Annuities (MYGA)

These function similarly to CDs but offer higher rates and tax-deferred growth. You receive a guaranteed interest rate for a set term.

Fixed Indexed Annuities (FIA)

Your returns are linked to a market index but never drop below 0% in a negative year. They provide upside potential with downside protection.

How to Lock in the Highest Annuity Rates in 2026

- Compare multiple insurance carriers.

- Look at AM Best financial strength ratings.

- Choose optimal surrender periods (3–7 years often offer best balance).

- Evaluate income rider costs vs benefits.

- Work with a fiduciary advisor.

Tax Benefits of Annuities

One of the strongest advantages of annuities is tax deferral. Unlike taxable brokerage accounts:

- No annual capital gains taxes

- No dividend taxation during accumulation

- Taxed only upon withdrawal

This makes annuities particularly attractive for high-income earners in Tier 1 countries facing elevated marginal tax brackets.

Who Should Consider a Fixed or Indexed Annuity?

- Pre-retirees aged 50–70

- Investors seeking guaranteed income

- High-net-worth individuals looking for tax-efficient growth

- Risk-averse retirees concerned about stock market volatility

Common Annuity Fees to Watch For

- Surrender charges (typically 5–10 years)

- Income rider fees (0.75%–1.25%)

- Administrative fees

- Premium bonuses with trade-offs

Pros & Cons of Fixed & Indexed Annuities

Pros

- Guaranteed principal protection

- Predictable retirement income

- High current interest rates (2026)

- Tax-deferred compounding

Cons

- Limited liquidity

- Surrender penalties

- Complex contract structures

Example: $250,000 Fixed Annuity Growth Scenario

If you invest $250,000 in a 5-year MYGA at 5.75%, compounded annually:

| Year | Balance |

|---|---|

| Year 1 | $264,375 |

| Year 3 | $296,061 |

| Year 5 | $331,833 |

This demonstrates the power of guaranteed, tax-deferred compounding over time.

Final Thoughts: Are Annuities Worth It in 2026?

With elevated interest rates and continued market uncertainty, fixed and indexed annuities are among the strongest retirement income solutions available in 2026. For conservative investors and retirees seeking stable income streams, these products can serve as a cornerstone of a diversified retirement strategy.

However, annuities are complex financial contracts. Always review terms carefully and compare multiple quotes before committing. When used correctly, they can provide peace of mind, guaranteed income, and long-term financial security.

Frequently Asked Questions (FAQ)

Are annuities safe?

Yes, when issued by highly rated insurance companies. Check AM Best ratings before investing.

Can I lose money in a fixed indexed annuity?

No, your principal is protected from market losses, though growth may be capped.

What is the best annuity term in 2026?

5- and 7-year terms currently offer some of the most competitive guaranteed rates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Rates and features change frequently. Consult a licensed financial advisor before making investment decisions.