Best Business Credit Cards with 0% APR & High Cashback Rewards in 2026

Best Business Credit Cards with 0% APR & High Cashback Rewards in 2026

In 2026, access to flexible financing and premium rewards is more critical than ever for entrepreneurs, startups, and established enterprises. Whether you operate a small LLC, a fast-growing SaaS company, an eCommerce brand, or a consulting agency, the right business credit card can unlock 0% APR financing, high cashback rewards, large welcome bonuses, and powerful expense management tools.

This comprehensive guide explores the best business credit cards with 0% APR and high cashback rewards in 2026, focusing on Tier 1 countries like the United States, Canada, the United Kingdom, and Australia — where financial products offer competitive rates and premium perks.

Why Business Credit Cards Matter in 2026

Modern business credit cards are no longer just payment tools. They provide:

- Introductory 0% APR on purchases for up to 12–18 months

- High-value cashback rewards (up to 5%)

- Massive welcome bonuses worth $500–$1,500+

- Expense tracking & integrations with accounting software

- Employee cards with spending controls

- Fraud protection & travel insurance

For cash-flow sensitive businesses, a 0% APR period can function as interest-free working capital. Meanwhile, high cashback cards can return thousands of dollars annually on advertising, shipping, travel, and software subscriptions.

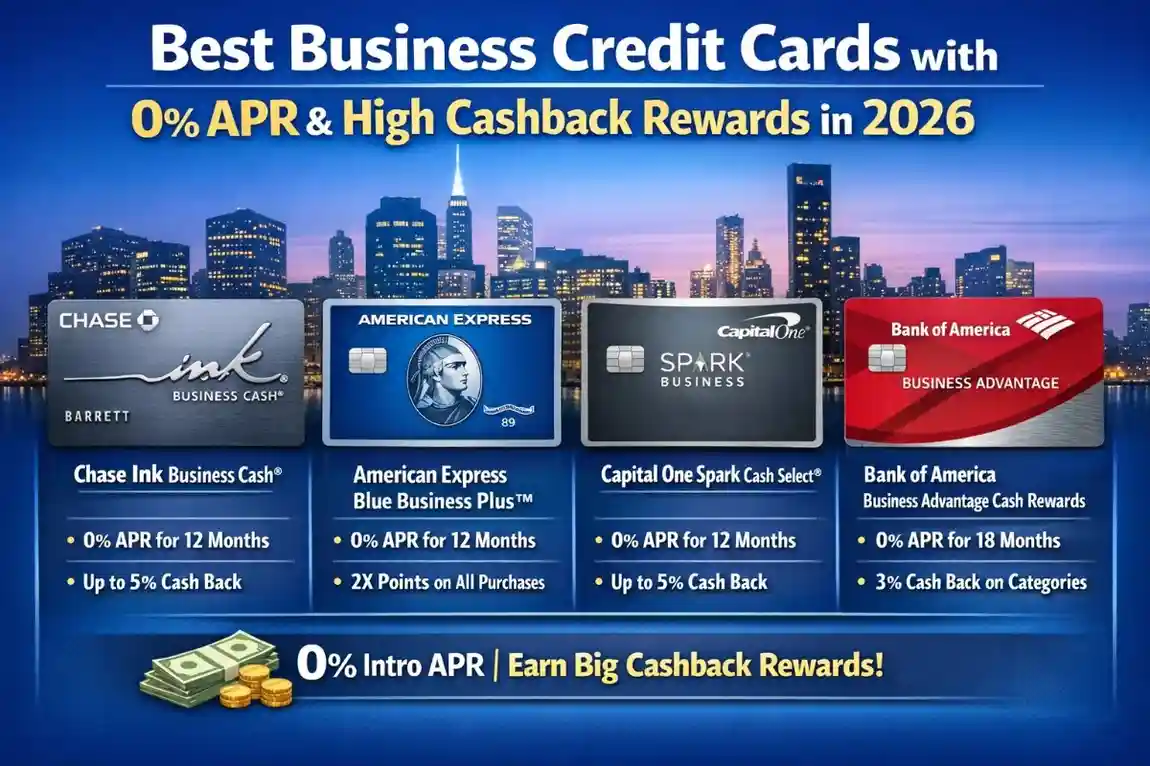

Top Business Credit Cards with 0% APR & High Cashback in 2026

| Card Name | Intro APR | Top Cashback | Annual Fee | Best For |

|---|---|---|---|---|

| Ink Business Unlimited® | 0% APR (12 months) | 1.5% unlimited | $0 | Flat-rate cashback |

| Ink Business Cash® | 0% APR (12 months) | 5% categories | $0 | Office & telecom spending |

| American Express Blue Business Cash™ | 0% APR (12 months) | 2% cashback | $0 | High everyday spending |

| Capital One Spark Cash Plus | N/A (Charge Card) | 2% unlimited | $150 | High-limit businesses |

| U.S. Bank Business Triple Cash | 0% APR (15 months) | 3% categories | $0 | Fuel, dining & travel |

1. Ink Business Unlimited® Credit Card

The Ink Business Unlimited® remains one of the most popular small business credit cards in 2026.

Key Features

- 0% Intro APR on purchases for 12 months

- Unlimited 1.5% cashback on all purchases

- No annual fee

- Generous welcome bonus (often $750+)

This card is ideal for business owners who want simple, predictable rewards without tracking bonus categories.

2. Ink Business Cash® Credit Card

Also issued by , the Ink Business Cash® is tailored for companies with significant office and telecom expenses.

Rewards Structure

- 5% cashback on office supplies & internet/cable/phone

- 2% cashback at gas stations & restaurants

- 0% APR for 12 months

- No annual fee

Marketing agencies, IT consultants, and remote-first startups benefit heavily from this structure.

3. American Express Blue Business Cash™ Card

The Blue Business Cash™ offers one of the highest flat cashback rates available.

Highlights

- 2% cashback on all eligible purchases (up to cap)

- 0% intro APR for 12 months

- No annual fee

- Expanded buying power

American Express business cards are known for premium customer service and powerful expense management dashboards.

4. Capital One Spark Cash Plus

The Spark Cash Plus is designed for businesses with large monthly expenses.

Why It Stands Out

- Unlimited 2% cashback

- No preset spending limit

- High-value sign-up bonus

- Annual fee: $150

This card is excellent for scaling businesses with heavy advertising spend on platforms like Google Ads and Meta Ads.

5. U.S. Bank Business Triple Cash Rewards

Offered by , this card provides one of the longest 0% APR periods available in 2026.

Key Benefits

- 0% APR for 15 months

- 3% cashback on gas, dining, office supplies & travel

- No annual fee

- Cell phone protection coverage

How to Choose the Right Business Credit Card

1. Evaluate Your Spending Categories

If your business spends heavily on advertising, travel, or software subscriptions, choose a card offering high cashback in those categories.

2. Compare Intro APR Length

For financing inventory or equipment, prioritize cards with 12–15 months of 0% APR.

3. Consider Welcome Bonuses

Many top cards offer bonuses worth $750–$1,500, which significantly increase first-year value.

4. Review Annual Fees

High-fee cards can still deliver strong ROI if rewards exceed costs.

Business Credit Cards vs Corporate Credit Cards

Small Business Credit Cards are designed for LLCs, sole proprietors, and startups. Approval often considers personal credit.

Corporate Credit Cards typically require higher revenue and do not rely on personal guarantees.

Benefits of 0% APR Business Credit Cards

- Interest-free financing

- Cash flow flexibility

- Debt consolidation

- Equipment & inventory funding

Maximizing Cashback Rewards in 2026

To optimize returns:

- Use category cards strategically

- Stack with vendor discounts

- Redeem points for statement credits

- Monitor bonus caps

Common Mistakes to Avoid

- Missing minimum spend requirements

- Carrying balances after intro APR ends

- Ignoring foreign transaction fees

- Applying for too many cards simultaneously

Are Business Credit Cards Worth It in 2026?

Absolutely. With high welcome bonuses, elevated cashback percentages, and extended 0% APR financing, business credit cards remain one of the most powerful financial tools for growth-focused entrepreneurs in Tier 1 markets.

Final Thoughts

The best business credit card for you depends on spending habits, financing needs, and long-term growth plans. Cards from major issuers like , , , and continue to dominate the market in 2026.

Before applying, review the latest terms, APR ranges, and bonus offers directly from the issuer to ensure eligibility and maximize value.