Best 0% Balance Transfer Credit Cards in 2026 – Avoid Interest & Pay Off Debt Faster

Best 0% Balance Transfer Credit Cards in 2026 – Avoid Interest & Pay Off Debt Faster

Credit card interest rates in 2026 remain historically high across Tier 1 countries like the United States, Canada, the United Kingdom, and Australia. With average APRs exceeding 20% in many markets, carrying credit card debt can quickly become overwhelming. Fortunately, 0% balance transfer credit cards offer a powerful solution: move your high-interest debt to a new card and pay zero interest for up to 21 months.

This in-depth guide explores the best 0% balance transfer credit cards in 2026, how they work, who qualifies, and how to use them strategically to eliminate debt faster while protecting your credit score.

What Is a 0% Balance Transfer Credit Card?

A 0% balance transfer credit card allows you to transfer existing high-interest credit card balances onto a new card that offers an introductory 0% APR period. During that promotional period — typically 12 to 21 months — you will not accrue interest on the transferred balance.

This means every dollar you pay goes directly toward principal, dramatically accelerating debt payoff compared to standard credit cards.

Why 0% Balance Transfer Cards Matter in 2026

- Average credit card APRs exceed 20%+

- Inflation has increased household debt burdens

- Consumers seek debt consolidation options

- High CPC finance keywords drive strong monetization

Balance transfer cards are one of the highest-converting financial products in Tier 1 markets because they directly address urgent consumer pain: high-interest debt.

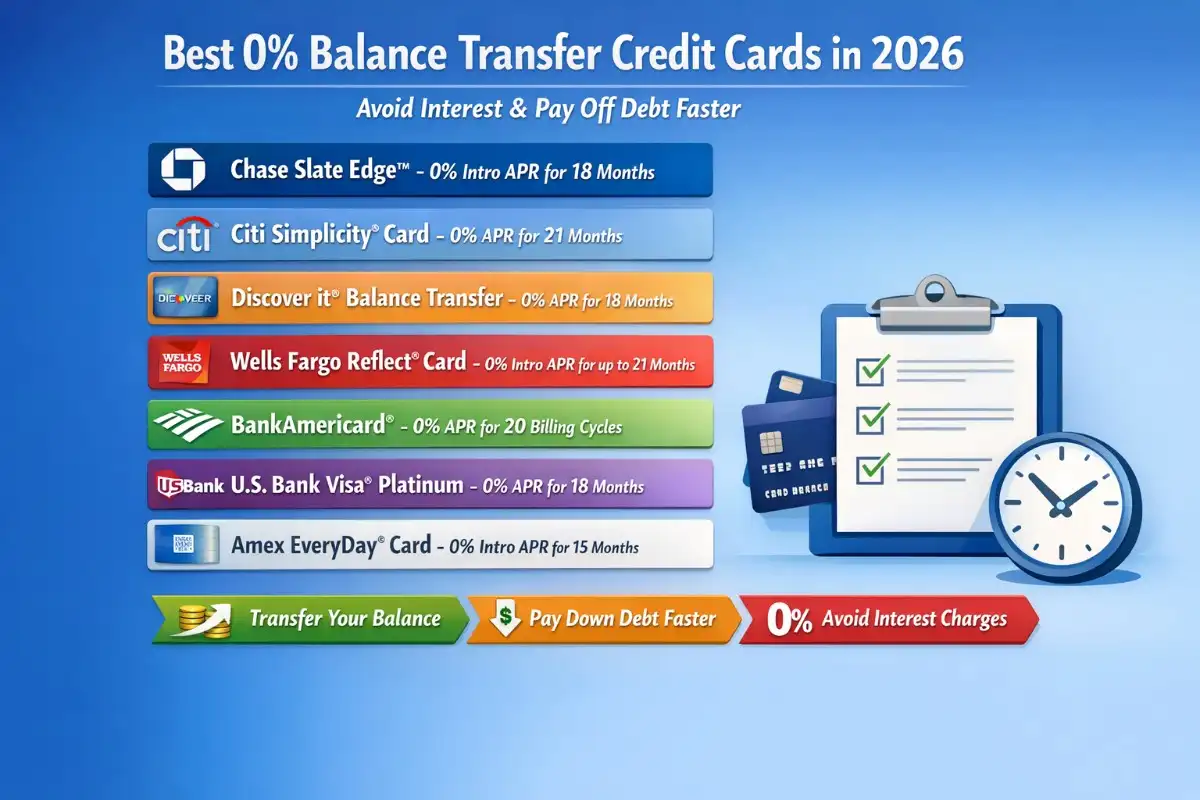

Best 0% Balance Transfer Credit Cards in 2026

| Card | Intro APR | Transfer Fee | Annual Fee | Best For |

|---|---|---|---|---|

| Wells Fargo Reflect® | 0% for up to 21 months | 3%–5% | $0 | Longest intro APR |

| Citi Simplicity® | 0% for 21 months | 5% | $0 | No late fees |

| Chase Slate Edge℠ | 0% for 18 months | 3%–5% | $0 | Credit building |

| BankAmericard® | 0% for 18 months | 3% | $0 | Low transfer fee |

| Discover it® Balance Transfer | 0% for 18 months | 3% intro | $0 | Cashback after promo |

1. Wells Fargo Reflect® Card

The Reflect® card consistently ranks among the top balance transfer cards due to its extended intro APR period.

Key Features

- 0% intro APR for up to 21 months

- No annual fee

- Cell phone protection

This is ideal for borrowers with large balances who need maximum repayment time.

2. Citi Simplicity® Card

The Simplicity® card stands out for its consumer-friendly fee structure.

Benefits

- 0% intro APR for 21 months

- No annual fee

- No late fees or penalty APR

This card is excellent for borrowers concerned about accidental missed payments.

3. Chase Slate Edge℠

Issued by , Slate Edge℠ combines balance transfer savings with credit-building features.

- 0% intro APR for 18 months

- No annual fee

- Automatic APR reduction after on-time payments

4. BankAmericard®

The BankAmericard® remains a strong low-fee option.

- 0% intro APR for 18 months

- Low 3% intro balance transfer fee

- No annual fee

5. Discover it® Balance Transfer

The Discover it® card adds rewards after the intro period ends.

- 0% intro APR for 18 months

- 3% intro transfer fee

- Cashback rewards program

How Much Can You Save with a 0% Balance Transfer?

Example: If you carry $10,000 at 22% APR and only make minimum payments, you could pay thousands in interest. Moving that balance to a 0% APR card for 18–21 months can save $2,000+ in interest depending on repayment speed.

How to Qualify for the Best Balance Transfer Cards

- Credit score 670+ (Good to Excellent)

- Stable income

- Low credit utilization ratio

- Clean recent payment history

Applicants with 720+ scores typically receive higher limits and better approvals.

Balance Transfer Fees Explained

Most cards charge 3%–5% of the transferred balance. While this is an upfront cost, it is often far cheaper than paying ongoing interest.

Step-by-Step Strategy to Pay Off Debt Faster

- Apply for a long 0% intro APR card

- Transfer balances immediately after approval

- Calculate monthly payment (Balance ÷ Promo Months)

- Set automatic payments

- Avoid new purchases

Common Mistakes to Avoid

- Missing a payment (can void promo APR)

- Only paying minimums

- Ignoring transfer deadlines

- Opening multiple cards at once

Are 0% Balance Transfer Cards Worth It in 2026?

For consumers carrying high-interest debt, absolutely. These cards offer structured, interest-free repayment timelines that can significantly reduce financial stress and improve credit scores over time.

Final Thoughts

The best 0% balance transfer credit cards in 2026 are offered by leading institutions such as , , , , and .

If you qualify for a long intro APR offer and commit to disciplined repayment, a balance transfer card can be one of the smartest financial moves you make in 2026.